While China's new leader, Xi Jinping, may prove conservative in foreign policy, China watchers say, the course of economic reform is likely to continue, and maybe even increase its pace.

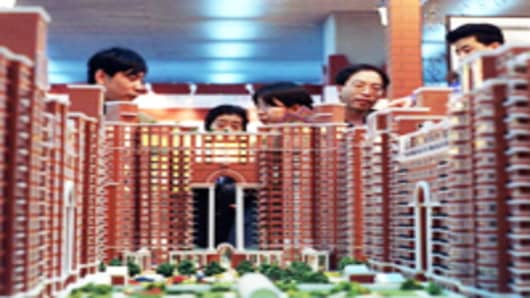

Few industries matters more to China's 1.3 billion population than real estate. Overtly, there is little sign of what the new administration is planning when it comes to the real-estate industry – but it is one of their thorniest issues.

Chinese property stocks have run up by 24 percent since September 5, according to MSCI data, buoyed by speculation that the new leaders would introduce stimulus measures in an early bid to win over the people. But analysts toned down their expectations as the leadership change came closer.

For instance, Societe Generale economist Wei Yao said in a report issued on Thursday that she expects the new leadership team to focus on long-term economic reform, working to push privatization and reduce the influence of state-owned enterprises, rather than inject money and inflation into the economy with short-term stimulus.

That suggests little support for the property industry, which has been starved of credit by almost three years of home-purchase restrictions by Beijing, which has also curbed bank lending to the sector.

The most likely tack for the new seven-member Politburo Standing Committee on the real-estate front is a gradual shift away from draconian rules on home ownership, which economists say produce unexpected consequences.

"The leadership likely will continue pursuing structural reforms which fall within its remit, such as phasing in a new national real estate tax system to replace the use of administrative orders to interfere in the market," independent economist Andrew Ness said in a report for the U.S.-based Urban Land Institute, which dealt with the effects of the leadership transition on the property industry.

Shanghai and Chongqing have already introduced property taxes, and a gradual rollout into other big cities is likely. A tax on home ownership would ease the pressure on local governments, which generate the bulk of their budget from land sales.

Ness notes that it would also encourage owners in big cities to rent out their properties rather than leave them empty for speculative purposes. Beijing has already introduced "use it or loose it" rules to discourage developers from sitting on land banks for years, waiting for a strong property market.

(Read More: As 18th Congress Ends, a Peek Into the Process)

The Minister of Housing and Urban-Rural Development gave a briefing during the Communist Party Congress, the main point being that there will be no immediate easing of the home-purchase restrictions first put in place in 14 cities in April 2010. They have since been expanded to 48 cities, making it hard to own more than one property in major cities, and restricting non-residents from buying at all.

The other commitment of the ministry was to build around 6 million units of affordable housing in 2013, something that is likely to benefit cement and construction companies such as state-owned contractor China State Construction International Holdings . The main residential developers such as China Vanke, China Evergrande and China Overseas Land & Investment have shown little interest in developing affordable housing, preferring to focus on mid- to high-end homes.

Beijing will eventually have to address high rents and home prices since those issues have caused widespread discontent. Though many people believe the central government can turn demand for property on and off by mandate, Patrick Chovanec, a business professor at Tsinghua University, doubts Beijing has that much control over market forces.

"A lot of people are saying the government is going to loosen and then the market is going to come surging back," Chovanec said. "It's a story a lot of people buy into, and it suits the government, because it says we're in charge, and we're controlling the market ."

He added that there is too much supply, which will drive down prices, despite decent demand, even if the government eases its curbs. By his estimation, there is already four years' worth of residential construction under way in China now, eight years' worth of office space and nine years' worth of retail. The demand may be real, but too much supply will push prices lower.

(Read More: Property Curbs to Wait as China Focuses on Growth)

"There's 1.3 billion people who are happy to move into as nice a place as possible," Chovanec said. "The question is at what price? People who are bullish point to urbanization and rising incomes, and both of those are true."

Even though private property ownership was only recently formalized in Communist China, overseas Chinese have a strong tradition of putting their money into hard assets such as homes. Real-estate investment is one of only a handful of options open to mainland Chinese, where the stock markets are notoriously volatile and capital controls require nearly all money to remain at home.

"China has been turned into a nation obsessed with real estate, and specifically housing ownership, with possession of a flat being the chief sign of financial security," Ness said.

Growth Driver

Therefore the property sector is very crucial to China's society and economic growth.

China's growth slowed to 7.4 percent in the third quarter, the lowest level of growth in three and a half years. IHS Global Insight is forecasting the same rate of growth for the full year, and 7.6 growth in 2013, driven by the government's investment in low-cost housing, as well as consumer spending and investment. Those forecasts still leave China with the strongest growth in Asia, but far from its heady double-digit growth of the last 13 years.

Bricks and mortar account for a hefty chunk of that growth, with real-estate investment accounting for around 14 percent of its gross domestic product, according to National Bureau of Statistics data. So a slowdown in the sector will be a serious headwind.