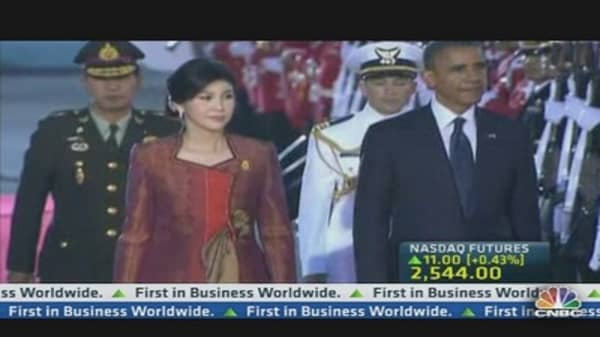

President Barack Obama flew into Myanmar on Monday, becoming the first U.S. head of state to visit the country - a former pariah state that has taken the world by surprise with speedy political and economic reforms in the past year after five decades of military rule.

The visit is of particular significance, analysts said, because it comes at a time when the opening up of Myanmar's economy threatens decades of influence by the Chinese.

(Read More: US to Demand Disclosures as it Eases Myanmar Sanctions)

A wish to distance itself from China has been a key driver behind recent economic reforms in Myanmar, says William Case, a professor of politics at City University of Hong Kong.

"The plain fact is that China, in its investments in Myanmar, probably overplayed its hand and just simply took too much. That became a big source of resentment on the ground and something the leadership picked up on," Case told CNBC Asia's "The Call."

"That is one of the things that has been driving this opening up and reaching out to other parts of the world," he added.

Construction on a major Chinese hydroelectric dam worth $3.6 billion was suspended last year after outrage erupted over Chinese attitudes towards local people and their environment, according to media reports.

China is Myanmar's biggest trading partner, followed by Thailand. Bilateral trade between China and Myanmar was worth about $3.6 billion in the fiscal year 2011-12, according to Myanmar's Ministry of Commerce.

Analysts added that as Myanmar now improves relations with the U.S. China fears its strategic relationship with Myanmar that also offers it access to the Indian Ocean and a short-cut for oil deliveries from the Middle East could be hurt.

That will only add to the list of issues China's new leadership team will have to tackle, said regional analysts.

(Read More: Special Report, Changing China: The New Leaders)

"Myanmar is wedged between India and China, its underdeveloped agriculture offers potential. Others recognize this, not least the U.S.," said Sean Turnell, a senior lecturer at the Department of Economics at Australia's Macquarie University.

"The U.S. trip to Myanmar is partly about recognizing the change that has taken place, but also about providing a balance to China's power. China will play down Obama's visit, but it is clearly an issue for them (Chinese leaders)," Turnell told CNBC.

(Read More: For Southeast Asians, Obama's Re-Election Offers Continuity)

China's Feathers Ruffled?

Sean King, senior vice president at Park Strategies in New York agreed, saying Obama's visit would "ruffle feathers" in China.

He said energy, infrastructure and consumer goods sectors were the ones that were most likely to benefit from increased foreign investment into Myanmar.

And Chinese influence in Myanmar is under threat not just from the U.S., but other countries keen to take advantage of an opening up of the economy.

"The first mover advantage will go to Japan, which is gaining a hold there," said King. "The Japanese will probably do well because Japanese brands are popular there."

According to a recent report from Reuters, Thein Sein, a former general who now heads Myanmar's civilian government, has worked hard in the past year to ink a deal with Japan to develop a special economic zone in return for $18 billion in aid, investment and debt forgiveness.

Still, analysts believe foreign firms may have difficulty making deals in Myanmar in the short-term since many contracts have already been signed with the Chinese, who will probably continue to dominate the key resources sector in the short to medium term.

Data from the Myanmar Investment Commission shows that China invested about $13.6 billion in Myanmar in the 2010-11 fiscal year, mostly in the energy sector.

Foreign firms may have better luck making progress in the consumer sector, analysts added.

"Western companies will look at those (resource) sectors in some way, but will probably want to develop other sectors such as financial services, credit cards, consumer goods," said Case at City University of Hong Kong.

"There's an enormous and untapped consumer market there that will take years to develop. The potential is plainly there, that is what is probably attractive to foreign countries," he added.

- By CNBC's Dhara Ranasinghe, follow her on twitter @DharaCNBC