House Republicans unveiled their proposed tax overhaul on Thursday. The plan seeks to immediately double the estate tax exemption and get rid of the tax altogether in six years.

The estate tax — a tax on cash, real estate, stock or other assets being transferred from one generation to the next — was first introduced in 1916, when it levied a tax of 10 percent on estates valued at $5 million or more. At its peak, it levied a tax of 77 percent on estates worth $10 million or more.

Under current rules, any individual's estate that exceeds $5.49 million in value, or a married couple's estate that exceeds $10.98 million, is taxed up to 40 percent upon the owner's death.

Since the threshold is so high, the very richest Americans are alone in paying the tax.

"Only the estates of the wealthiest 0.2 percent of Americans — roughly two out of every 1,000 people who die — owe any estate tax," reports the Center on Budget and Policy Priorities. "This is because of the tax's high exemption amount, which has jumped from $650,000 per person in 2001 to $5.49 million per person in 2017."

The Tax Policy Center estimates that only about 5,500 returns will owe estate taxes. That means the vast majority of Americans wouldn't be affected by this part of the GOP plan.

The GOP frames the issue in terms of fairness. House Ways and Means Committee Chairman Kevin Brady calls the tax "un-American": "You work your whole life to build up a nest egg or a family-owned business or family farm. Then you pass away. ... Uncle Sam can swoop in and take over 40 percent of everything you've earned over a certain amount."

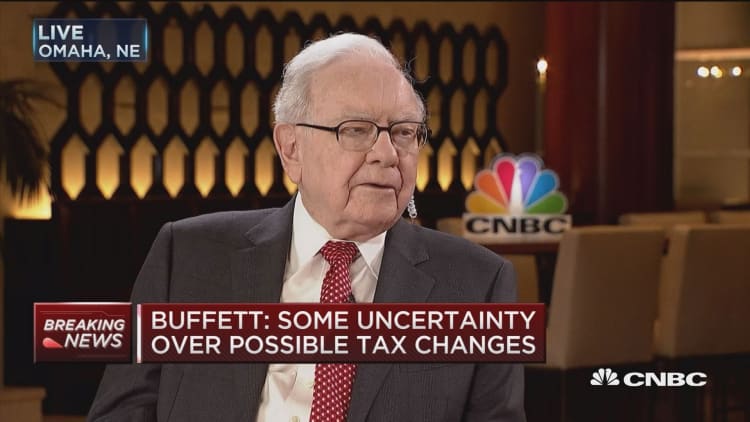

But billionaire Warren Buffett told CNBC last month that eliminating the estate tax would be a "terrible mistake."

A repeal could lead to yet more dynasty building, Buffett said on "Squawk Box": "If they pass the bill they're talking about, I could leave $75 billion to a bunch of children and grandchildren and great-grandchildren. And if I left it to 35 of them, they'd each have a couple billion dollars."

That would concentrate funds in the hands of the few. "Is that a great way to allocate resources in the United States?" he asked, rhetorically.

"The wealthy now are so much wealthier than they were 25 years ago," the billionaire said. "We're talking about the 400 [richest] now having $2.4 trillion ... 25 times as much money."

CPA David First brings up a similar point. "This is going to be a boon to rich people," he told CNBC's Jessica Dickler. "All the billionaires are going to save billions of dollars."

This is an updated version of a story that was previously published in October.

Like this story? Like CNBC Make It on Facebook!

Don't miss: Chart shows exactly how Trump's tax reform could affect you