A 34-year-old San Francisco-based entrepreneur has a surprisingly high balance: 10,308,398. That's not his checking account balance or the amount of debt he owes — it's the total number of credit card reward points he currently has across over a dozen cards.

Chris Hutchins — a former Google employee and owner of Grove, a financial planning company — started playing the credit card points game in college, and more than a decade later, he's finally reached his dream of having more than 10 million points.

"It's been an evolving goal," Hutchins tells CNBC Make It. "When I first started I wanted to get a million." Hitting seven digits only spurred him on more. For the last five years, he's been steadily working toward the next milestone, which he officially hit this month.

That's not to say he never spends down the reward points he, along with his wife, Amy, have been carefully accumulating. His points total across all of their cards does fluctuate month to month, especially when the couple is planning their latest travel adventure.

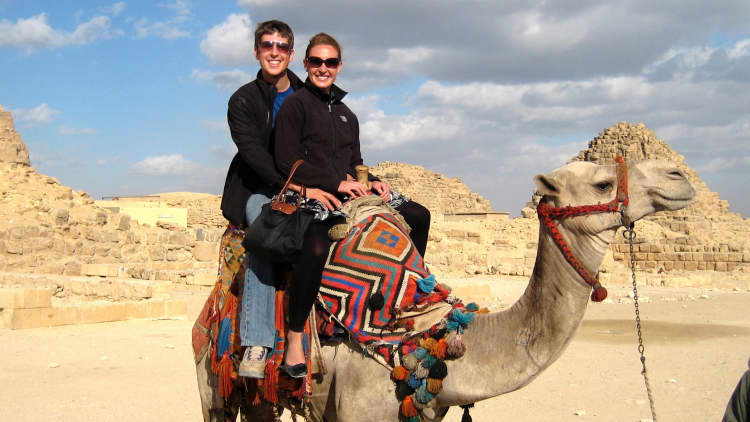

Racking up credit card reward points is not just about hitting the big number, Hutchins says. The rewards allow him to indulge in the one thing he loves but would never otherwise splurge on: travel. Over the years, Hutchins and his wife have taken trips to Europe, India, Egypt, Japan, and even Bora Bora last year, all using credit card points.

"With credit card rewards, the magic is finding the thing that you care about that you can use them to maximize it," he says.

And not all the points are used to jet to exotic locales. Hutchins says he cashed in points for a flight to Denver last month because it was a better deal. Yet despite spending his rewards, he still racks points up at a higher rate than he spends them, hence the current 10.3 million total.

Hutchins admits his credit card usage is "extreme." The average person has about three credit cards. But Hutchins is not average. He has 16 credit cards and a credit score of 817, while Amy also has several cards in her name, too.

How he got started gaming credit card rewards

First, there was just a single card: a United Airlines credit card Hutchins got in college.

"I was like, 'Man every time I spend a dollar I get a mile, and if I get enough credit card points I could fly somewhere for free,'" Hutchins reminisces, saying that he's loved traveling his whole life. "I think my love for travel is what drove this. I thought: 'Wow, I don't have a lot of money, but if I maximize my points I can go on these trips and I don't have to pay for them.'"

In 2005, while in college, Hutchins cashed in his points and flew to Europe on a whirlwind summer vacation with his then-girlfriend/now-wife, Amy, which included stops in France, Italy and Spain.

I think my love for travel is what drove this. I thought: 'Wow I don't have a lot of money, but if I maximize my points I can go on these trips and I don't have to pay for them'Chris Hutchins

After the 2008 financial crisis, Hutchins co-founded Milk, a mobile app incubator in San Francisco, which was acquired (and Hutchins was hired) by Google in 2012. From there, his wallet, and his interest in the credit card points game, grew exponentially.

'When I was working at Google, I would be the first person to volunteer to pay for the happy hour we are hosting for our team or plan the off-site that we're taking and book the venue," Hutchins says, adding that he was always volunteering to spend money when he would be reimbursed. "I think that's the source of a lot of point maximization."

The crazy things he does for points

Over the years, Hutchins has developed some creative hacks to score the biggest bang for his buck. For example, he buys Whole Foods gift cards at OfficeMax because he has a business credit card that gives 5 points for every dollar spent at office supply stores.

What really accelerated Hutchins' points total was some extreme party planning. "In the last eight years, I've had plenty of friends decide to get married and every single time there was a bachelor or a bachelorette party, I volunteered to help plan it," he says.

That meant paying upfront for trips to Cabo, Mexico, for example, which was a goldmine of points when you've got 15 people who need round-trip flights for $200 to $300 a pop, plus hotel rooms or a luxury rental house on the beach. And, of course, Hutchins put each one of those purchases on credit cards (such as American Express Platinum, which provides 5 points for every dollar you spend on flights) and was reimbursed later by his friends.

It might sound risky but with one exception, Hutchins says he can't remember his friends ever flaking out on paying him back. The only big hiccup was his bachelor party in Cartagena, Colombia. The group flew Spirit Airlines, and the airline canceled its service to the city during the trip so nobody had flights home. Because everyone all had to get back to work, they all had to purchase new flights on other airlines, rather than waiting for the rebooked flight Spirit offered days later.

"There was some contention about paying ... but eventually I got paid back," he says.

When all tallied, Hutchins says he easily earned 35,000 to 40,000 points for each bachelor party. "I've probably done that 10 to 15 times," he says.

His bachelor party weekends have slowed down in recent years, and Hutchins admits that now he generates more points through his business expenses. Even when he goes out to dinner, he doesn't rush to pick up the tab for the points.

"Now that I have so many points, when I go out to dinner I just let my friend pay for dinner and I pay them back," he says. "I'm at a level where getting the extra 50 points at dinner isn't going to be meaningful to my balance."

Making optimization a family affair

Hutchins would be a lot further from his goal without the help of his wife Amy, also 34. Since they have joint accounts and share their money equally, it made sense to get her involved in gaming the credit card rewards.

That meant that Amy, who works in business development at Lyft, had to get up to speed on how to best maximize points. In the beginning, when they would go out to dinner or shop together, Hutchins would quiz his wife on the best card to use to get the most amount of points.

And while it may seem overbearing, Amy says she quickly realized the benefits of making her purchases count. "It was one of those things that I was, frankly, annoyed by at first," Amy tells CNBC Make It. "But ultimately, I started seeing that our points were accruing in our accounts far more rapidly because I was making these pretty small changes."

"The first moment my wife and I took a vacation and we didn't spend anything on the flights and stayed at nice hotels, I think everything changed," Hutchins says.

He even typed out instructions on an index card, essentially a "cheat sheet" that identified which credit card to use for different types of purchases. "A part of me was like, 'This couldn't be more annoying,' and the other part of me was like, 'this is kind of cute,'" Amy says.

But while she understands the value of points, Amy says she still doesn't want to ever go "full-fledged nuts on optimization." Instead, she leaves the bulk of the organization to her husband.

"Thank god I married an optimizer so he essentially does [all the work] for me," she says with a laugh. "I joke with my friends and family that honestly, if he wasn't around, I don't know how I'd survive on my own because he's gotten so good at optimizing for me."

And Hutchins really does maximize the rewards potential. He even used points to hire a videographer for his wedding. "We told our videographer we were going to the Seychelles [for our honeymoon], and she had said 'Man, there's nothing I want more than go there with my husband.'"

So Hutchins stuck a deal: not only did he use points to get plane tickets for a Seychelles honeymoon for him and Amy, he used points to get the videographer and her husband tickets to the Seychelles in exchange for her working his wedding for free.

"He's essentially a life hacker," Amy says, adding her husband's desire to figure out ways to live better and be more efficient goes beyond just credit cards.

What it takes to maximize

While he loves to game any system, particularly credit card rewards, Hutchins is the first to admit it's not exactly effortless. Hutchins still has to do a bit of work to really optimize his rewards. In fact, he has two main spreadsheets he uses to keep track of all his points across those 16 different credit cards, most of which are offered through either Chase or American Express.

And of course, you have to keep spending. Currently, Hutchins estimates he spends about $90,000 a year on all his living expenses, over half of which (about $55,000) he puts on credit cards. Expenses such as the mortgage, property taxes and a dog walker are paid directly.

He estimates that given his current spending across all his credit cards, he averages about 3 points per dollar, so in any given year, he's earning at least 150,000 in points. On his AmEx Gold alone, Hutchins spends about $1,600 a month and over 84% of those purchases are at restaurants, which earns him 4 points per dollar.

"If you can't pay the bills at the end of the month, I would say points aren't worth it," Hutchins says. He tells people who are interested in getting into the credit card points game to make sure that they're able to get to a place with their cash flow that they're paying off their credit cards each month before they start earning the points on them because "it can get kind of costly," he says.

Not only that, he has to keep up with how airlines, hotels and the credit card companies change their policies for both accruing and cashing in the points. "The deeper you go down this rabbit hole of credit card points the more time it ends up taking," he says.

Living the point life

And yet, points are currency, at least for Hutchins. He estimates that if he didn't maximize credit card reward points, he and his wife would likely have to work five or 10 years longer to afford to travel and save for retirement. Instead, they spend what they would normally, but because they make the points work for them, they get to reap the rewards.

Since opening Grove in 2016, Hutchins says his personal travel has slowed a bit; he's now taking about two or three big trips a year. "The upside of owning a business is that you have a lot of business expenses and the downside is you have no time to take vacation," Hutchins says, adding he definitely maximizes those business purchases for points.

But when he does travel, the savings from his credit card rewards are worth every second he spends optimizing them. Hutchins estimates that he saves between $15,000 to $20,000 a year that he would otherwise have to pay to do the same type of traveling.

The points, he says, give him and Amy the freedom to enjoy luxuries he'd never want to spend money on. "There's no world where I would ever buy an international business class ticket with my money," Hutchins says.

Even after hitting the 10 million goal, he still plans to continue maximizing his points. But he says maybe he'll start really trying to spend down that crazy balance.

"I'll never stop optimizing, but at this point I'd love to never get to 15 million," Hutchins says. "I think if there's a lesson to take away from getting to 10 million, it's that nobody should ever get there, because it's just a sign that you aren't using your points."

Now he just wants to take a trip and drive the number down. "One trip I really want to take is to Australia and New Zealand, primarily because I went to Australia on a free trip without my wife and so I've been getting flak for that ever since."

"It's a great place to go with points because it's super far away and you need a lot of time so that's one trip I really want to take."

Don't miss: 5 things you need to know about booking a budget airline ticket, according to experts

Like this story? Subscribe to CNBC Make It on YouTube!