Small business confidence has dropped to a level not seen since 2017, matching the all-time low since CNBC and SurveyMonkey began taking the pulse of Main Street in a quarterly survey three years ago.

Business confidence is now lower than it was amid the major stock market sell-off of late 2018 and equals the way entrepreneurs felt in late 2017, when the tax cuts package and its provisions for small business owners were in doubt.

The reason this time: President Donald Trump's trade policy.

Small business owners are undoubtedly better off now than they were the last time the confidence index was this low. Over half of business owners in the CNBC|SurveyMonkey Small Business Survey for the third quarter of 2019 say that business conditions are good. That number was 13 percentage points lower (55% vs. 44%) at the time of the 2017 low. Fifty-eight percent say they expect revenue to increase in the next 12 months, and Trump's net approval rating is holding strong, at 57%.

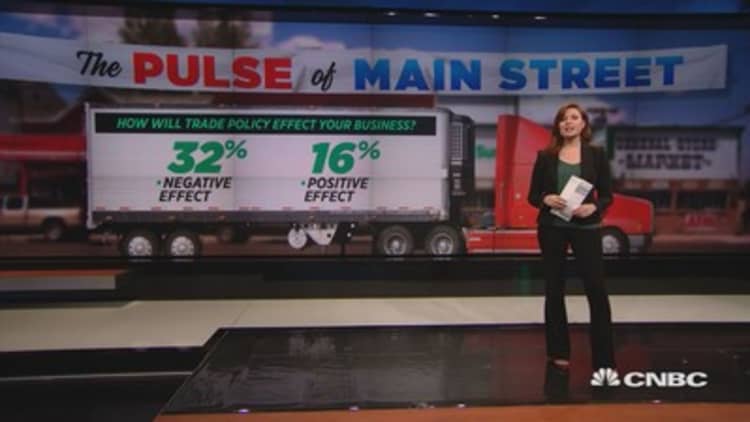

"Trade has become the new issue causing volatility for small business owners, as a growing number of small business owners say they expect trade policy to have a negative effect on their business in the next year," said Laura Wronski, senior research scientist at SurveyMonkey.

"There's been a huge divergence in the proportion of small business owners who expect positive versus negative effects from the Trump administration's trade policies. It used to be that those numbers were about even or even net positive, but now twice as many small business owners expect a negative impact as expect a positive impact from trade policy," Wronski said. "The big story of the summer has been the escalating trade war with China, and small business owners are reacting nervously."

The CNBC|SurveyMonkey Small Business Survey for Q3 included responses from approximately 2,300 small business owners across the country, collected between July 29 and Aug. 4.

Trade trickles down to Main Street

"That really bright outlook we saw two years ago has waned," said Molly Day, vice president of public affairs for the National Small Business Association. "We've been pretty concerned with threats of tariffs."

She said for small businesses it is important that Congress pass the trade deal with the nation's two biggest trading partners, Mexico and Canada, legislation known as the United States–Mexico–Canada Agreement (USMCA). China may be "three or four steps down the supply chain" for many small businesses, but it affects them, especially the longer it goes on.

The majority of small business owners still say that Mexico and China trade policy will not be a factor for their business, but entrepreneurs experiencing a direct or indirect hit are bringing down overall confidence.

"The trade piece really does impact people a lot, but it is not as easy to have that personal connection" at the small business level, Day said. "For some small businesses not importing or exporting, it may not have a direct impact, but I think it will trickle down in that things are costing a little more."

That's the case for Ben Thomas, owner of Five Pound Apparel in Springfield, Missouri — the name comes from the business mission to donate 5 lbs of food for every T-shirt bought by customers. His store's core products are "Made in America," and the business has a focus on what it considers "ethical" brands, but those brands have global supply chains.

"The trade war has yet to have a direct impact on our business, but we do expect it to have a small impact," said Thomas, who owns the store with his wife. "The impact would likely be a slight increase on the cost of some of our goods. We have brands that source products and labor from all over the world, primarily with the goal of having a positive economic and social impact on that particular section of the globe. Wholesale margins are thin enough that manufacturers will have to pass those to their customers (us), and we in turn will likely have to pass those on to the end consumer," Thomas said.

The one lever the administration has is trade, and where they go with trade will dictate how small business owners feel by the end of the year.Karen KerriganSBE Council

The longer the feud with China continues, the "deeper and wider" the impact will be on small businesses, said Karen Kerrigan, president and CEO of industry trade group SBE Council.

"It really represents this drag on confidence and optimism," she said. "Optimism is still relatively high, but slowly lowering. We are at a critical period in the economy."

She noted that a recent weak reading in business investment, which hit a three-year low in an otherwise positive Commerce Department report, is also bringing down confidence, and that makes removing the trade anxiety even more important for the business community.

"Small and mid-size businesses are depending on larger businesses. The agricultural community is depending on farmers to buy stuff," Kerrigan said. "If you can get a [China] trade deal, maybe not a comprehensive one but start with something, IP protection or market access, and get the USMCA through Congress, it would all be very positive for investments, the markets and small business," Kerrigan said.

She added: "The one lever the administration has is trade, and where they go with trade will dictate how small business owners feel by the end of the year."

Matt Laricy, a third-generation real estate agent who manages his own sales group based in Chicago, is worried about a recession. "I think we're on the brink of a recession, and I think it's a matter of time that this gravy train we've all been riding is going to sink on us," he said. "We're past due. ... I don't think we're going to see a 2008 type of recession where the world is ending. I do think that we're going to see a little bit of a gut check."

But his economic concerns do not represent a sudden shift based on the trade war or any single factor. "I think this trade war with China is not going to affect us [and], for the most part, the general consumer."

Prepare for the unpredictable

Laricy has been preparing for two years to take advantage of a downturn.

"What I decided to do about two years ago was open up a different savings account and fund it every month ... so that when the recession does hit, I'm going to double down on advertising while everybody else is falling out, so that way I get more business. Because people are still going to buy or sell [real estate]. It's just going to be more difficult."

Some business owners across the country are experiencing weaker conditions beyond their control, tied to short-term phenomena, like weather in the Midwest, which saw an unprecedented amount of rain earlier this year.

"Business was better in 2018 than this year," said Trice Stevens, owner of On the Fringe, a retail fashion and beauty store in South Bend, Indiana. "We have had a slower spring directly affected by the weather, and then we had jacket weather and rain most of May. We lost our peak spring buying season that usually happens March–May."

"There hasn't been a period where concerns are steady across the board — there's been a lot of turbulence,' Wronski said. "Business owners usually value predictability, but that has been a luxury in the past few years."

Election season isn't likely to help, and may already be starting to factor into the confidence trend. The Q3 survey finds entrepreneurs saying that Trump is the No. 1 issue they will be voting on in 2020.

"What we have found, and we have been doing this since 2007, is a clear dip when we get into election seasons," Day said. "The news is permeated with reports of the terrible things that this and that party are doing, and the 'country is doomed' and people internalize that, and I would not be surprised if that is tweaking things a bit."

The CNBC|SurveyMonkey Small Business Survey for Q3 was conducted across approximately 2,300 small business owners between July 29 and Aug. 4. The survey is conducted quarterly using SurveyMonkey's online platform and based on its survey methodology. The Small Business Confidence Index is a 100-point score based on responses to eight key questions. A reading of zero indicates no confidence, and a score of 100 indicates perfect confidence. SurveyMonkey publishes additional quarterly small business data and analysis.