Growing up as a gay kid in India, I always dreamed of living in the United States. The only problem was that no one in my family had ever ventured abroad, and my only exposure to the country was watching a few sitcoms. So coming to the U.S. with only $1,000 at the age of 25 and not knowing anyone was scary.

I boarded a plane and landed in Connecticut in the middle of winter. The first few months were hard. I had no credit, so finding a place to rent was a nightmare. Also I could not afford a car, and I didn't know how to drive, which meant I had to rely on walking everywhere. These were only a few of the challenges which made me almost want to give up.

More from Grow:

My side hustles bring in $5,000 a month: Here's my best advice

Barbara Corcoran: 'Not every side hustle is a business'—here's why

How a real estate side hustle helped us add $1 million to our net worth

I decided to give myself 12 months to succeed. I spent all my free time reading financial websites and blogs. I tried learning everything from how to buy a car to how to improve your credit score. I started working as a software engineer, lived frugally, and spent less than I earned. As things improved, I used some of the money I saved to get a secured credit card. I paid for driving lessons, and bought a car.

My persistence has paid off. Today, 12 years later, I live in the San Francisco Bay area. I still work as a software engineer, now in Silicon Valley. I built a net worth of $2.3 million. And last year, I started a blog called Financial Freedom Countdown. I created the blog to share my journey and connect with other like-minded people working to achieve their money goals.

Here are some of the biggest lessons I've learned on my way to financial freedom.

Always be on the lookout for new opportunities

While entrepreneurship and side hustles can certainly help you achieve your financial goals, what I have earned from my 9-to-5 job has been the main source of my net worth. If there is something you want to learn that could help you advance, I've found that there are so many free and affordable resources you can use to bolster both your technical and soft skills.

I used the local library to borrow books and learn about project management. Once I was well versed in the concepts; I passed the certification test and obtained my Project Management Professional (PMP) license. Moving from a software engineer role to managing a team helped me progress faster in my career.

I also often volunteered to go on assignments outside of my state. My employer appreciated my ability to adapt to new surroundings, and my clients were happy that I was able to work with them in person. Taking on these new challenges helped lead to bonuses and promotions.

If you're not sure where to start, have an honest conversation with your manager on what it would take to promote you. Articulate your goals, document your accomplishments along the way, and review both periodically to make sure you are on track.

Pay attention to your biggest expenses

When I moved to San Francisco, I rented an apartment, since mortgage payments on a house would have been half of my income. I knew some of my co-workers who had bought houses were stressed out because they were struggling to make their payments.

Gradually as my career advanced and I started earning more, I decided to look into buying a house. At this point my income was high enough that my monthly mortgage payments would not exceed 30% of my income.

Although my car was 10 years old, it was working well and had only 103,000 miles on it. Rather than lease a new car or buy a new one, I decided to keep driving my old car. Restricting my large fixed costs such as living expenses and car payments helped me focus on saving more and investing.

As you draft a budget, remember that small changes can make a difference, but finding discounts and cutting back on buying a latte every morning are only part of the equation. My best advice is to think about how much of your income you want to spend on your biggest expenses. What will give you enough breathing room? Remember that you can revise your numbers any time as things change.

Video by Courtney Stith

Understand your risk tolerance and invest wisely

When I started investing, I made several mistakes. I invested in individual company stocks which went bankrupt. I decided to dabble in natural gas futures without realizing that it was a poor proxy for the actual price of natural gas. When Bitcoin and other cryptocurrencies were surging in 2017, I bought into several initial coin offerings (ICOs).

But l learned from these mistakes and developed my personal investment philosophy. Exchanging time for money is a vicious cycle. Accumulating assets and avoiding liabilities helps you break free from this cycle. Anything that increases in value over a period of time is an asset. Anything that decreases in value over a period of time is a liability.

You work hard for your money, so make sure your money is working hard for you.

Today, the bulk of my net worth is invested in total market index funds. Instead of selecting individual stocks, index funds give me an ownership stake in all the listed companies. For a very low price, my money is now diversified among thousands of companies, so I'm not dependent on the fortunes of a single company. Index fund investing also ensures that I do not need to spend time analyzing every company in my portfolio.

I also invest in real estate. Real estate prices typically increase at the rate of inflation. However, since homes are often purchased with a down payment and a fixed-rate mortgage, you can get the benefit of leverage without the risk. With a home mortgage, as long as you continue making the payment on a fixed-rate loan, you can ride the ups and downs of the housing market while keeping your eyes on the horizon.

The assets you select to invest in will depend on your time, knowledge, unique circumstances, and your risk tolerance. For example, I bought my house in the San Francisco Bay area before I obtained my green card. In the aftermath of the Great Recession, houses in the area were available for $500,000. As an owner-occupant, a 5% down payment was required. There was a risk that I could lose my down payment if I ran into issues with my immigration status. But I felt that the potential for appreciation if everything fell in place was too big to be ignored.

I was fortunate that my risk paid off: Seven years later, the house price has doubled.

Explore the asymmetric bets in your life. If you have an opportunity to launch a side gig or go in on an investment, if possible, start with a small amount of time and money to see if you have a viable idea before you expand.

Take every chance to build relationships

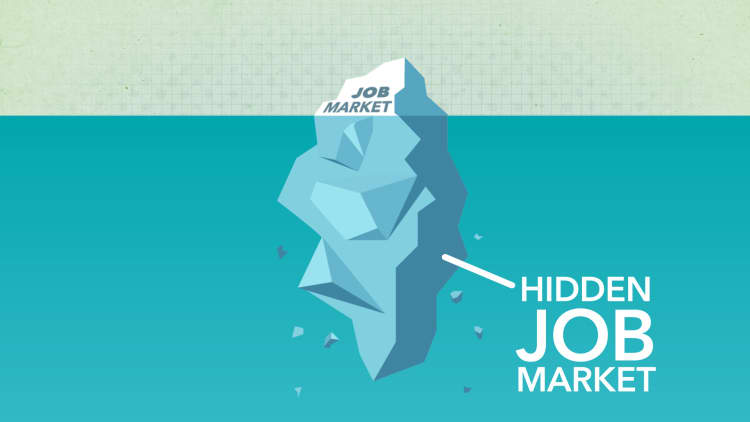

It was initially tough for me to break into Silicon Valley with a college degree that wasn't from a U.S. university. But when I got to interact with people in my industry one-on-one and build those relationships, that became less of an obstacle.

Even if you are not looking for a job, it's helpful to network with recruiters and headhunters, and take interviews to keep your skills sharp.

I stayed in touch with one of the recruiters I met years ago at a job fair, and they forwarded my resume to the hiring manager of the company I first joined in San Francisco. Keep the lines of communication open with your former coworkers and bosses. Meet with them regularly and nurture your professional relationships. You never know when they have a job opening and want you to join them, or vice versa.

Video by Mariam Abdallah

I firmly believe that you are the average of the five people you spend the most time with. Money can sometimes be tough to discuss openly with family, friends, and co-workers, but online communities are a great way to bridge that gap.

Before I started my website, I read a lot of other financial websites and blogs. Following the individual bloggers' monthly progress updates and commenting on their articles resulted in enduring virtual friendships. I would replicate some of their investment plans and use their success as motivation to achieve my own financial goals. I hope my experience can teach and inspire others to do the same.

John, who prefers to go only by his first name, came to the U.S. with only $1,000 and not knowing anyone. In 12 years, he achieved financial freedom. He writes at Financial Freedom Countdown and resides in the San Francisco Bay Area, where he enjoys nature trails and weight training.

The article "How I Came to the U.S. With $1,000 and Built a Net Worth of $2.3 Million" originally published on Grow+Acorns.