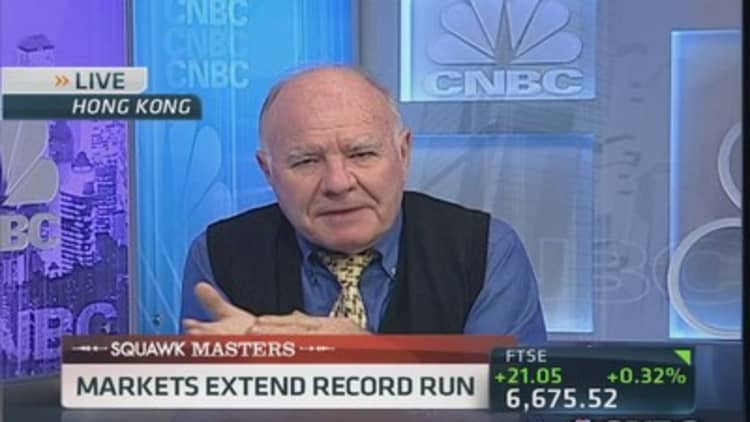

Leave it to uber-bear Marc Faber to bring bad news on Black Friday.

Faber, editor and publisher of The Gloom, Boom & Doom Report, told CNBC on Friday he believes a "massive speculative bubble" has encroached on everything from stocks and bonds to bitcoin and farmland. He attributed the vast bubble to "symptoms of excess liquidity."

Faber said the markets, which have reached record highs, could still rise before the bubble bursts, if stimulus programs such as the Federal Reserve's massive monthly bond purchases and super-low interest rates continue.

"Now can the market go up another 20 percent before it tumbles?" Faber said on "Squawk Box". "Yeah, it can go up even more, if you print money."

(Read more: Take cover! Bond market 'hell' could be on the way)

Warning investors that they could see disappointing long-term returns in equities, Faber said he thought a correction in equities was overdue when the index crossed 1,600 points. The benchmark index surpassed 1,808 points this week.

Faber pointed to a high Shiller price-to-earnings ratio, a market indicator named after Yale University professor and Nobel Prize winner Robert Shiller, which relies on 10 years of adjusted inflation, as an indicator of the bubble. He said a high Shiller P/E ratio suggests low returns in the future.

(Read more: Superbear Marc Faber sees opportunities)

Faber also referred to the rapid rise of bitcoin, the digital currency that crossed $1,200 early Friday, as an area affected by excess liquidity.

"Farmland is up 10 times over the last 10 years," Faber said. "And bitcoins are up now and who knows what next will go up."

During recent interviews with CNBC, Faber predicted that European equities would outperform stocks in the U.S. and emerging markets, and that a credit boom in China puts the world in a worse position than it was in 2008, before the global financial crisis.

— By CNBC's Jeff Morganteen. Follow him on Twitter at @jmorganteen. Reuters contributed to this report.