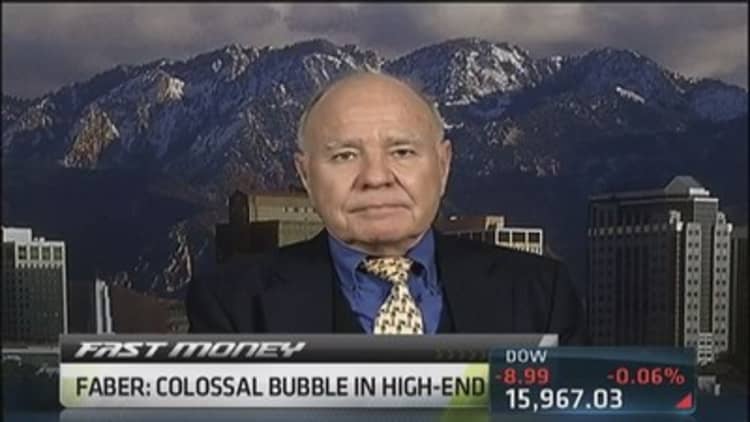

European equities are poised to outperform U.S. stocks and emerging markets, Boom Gloom & Doom Report editor Marc Faber said Tuesday.

"At the present time, I think that Europe has had a very good move from the lows. It outperformed the U.S., and I would be a little bit careful to buy stocks indiscriminately at the present time because everything has moved up significantly. There's a lot of bullish sentiment," he said.

"But in general, I like selected European companies because their business is international and their exposure to Europe is not all that large. Maybe 40 to 50 percent of their total sales are in Europe, and the rest is overseas.

(Read more: 'Some pockets of value left' in stocks: Kate Moore)

On CNBC's "Fast Money," Faber said that he owned stock in telecom companies, utilities and blue-chip companies in Switzerland. He also disclosed that he was holding on to 10-year Treasurys and adding to his gold positions.

Known as a market bear, Faber also said bubbles are forming in some areas.

(Read more: Dennis Gartman likes 'simple things': Coal, steel, copper)

"I see a bubble in everything that relates to the financial sector," he said. "We have a bubble in bonds. We have a bubble in low-quality bonds. We have a bubble in equities. If you look at the financial sector as a percentage of the global economy, it's very large. We have a huge debt bubble, and it's only getting bigger. It's not getting any smaller.

"Everything that is in the financial sector is the bubble, and it's been pumped up by central banks."

Faber also called "a colossal bubble" in the high-end sector, adding, "Think diamonds and the prestige art and luxury."

While the luxury sector has been strong, costs have also been going up and competition has increased, Faber said. "The outlook is relatively favorable, but tastes may change."

Faber said that the nomination of Janet Yellen to head the Federal Reserve could lead to an even bigger bubble.

(Read more: Bull markets don't stop at 'cheap': Josh Brown)

"With all this collection of dovish professors at the Fed, that actually the asset-purchased programs could be increased—not tapered, increased," he said. "There's no great value in equities with very few exceptions, but it can become even more overvalued."

The Nasdaq was overvalued in the summer of 1999 but continued climbing until March 2000, Faber noted.

"The fact that the market goes up doesn't necessarily make it good value," he said.

Faber said that he saw value in mining companies, particularly precious metals.

— By CNBC's Bruno J. Navarro. Follow him on Twitter @Bruno_J_Navarro.