Allianz Chief Economic Adviser Mohamed El-Erian gave a gloomy outlook for global markets Thursday, as the Dow Jones industrial average continued its largest two-day slide since March.

"What we're seeing is a classic overshoot that starts in the emerging markets world and it starts spreading," he told CNBC's "Squawk on the Street" in an interview. "What that causes is heightened risk aversion."

El-Erian noted the outflows of funds hits emerging markets the hardest first, with the capacity to send shock waves to other markets "and at the end is the equity market in the U.S."

Read More Dow slips triple digits, Nasdaq briefly off 1% as growth concerns weigh

Invoking emerging markets in the 1990s, El-Erian said he was "having some flashback because that's an asset class that always overshoots because the dedicated investor base is small."

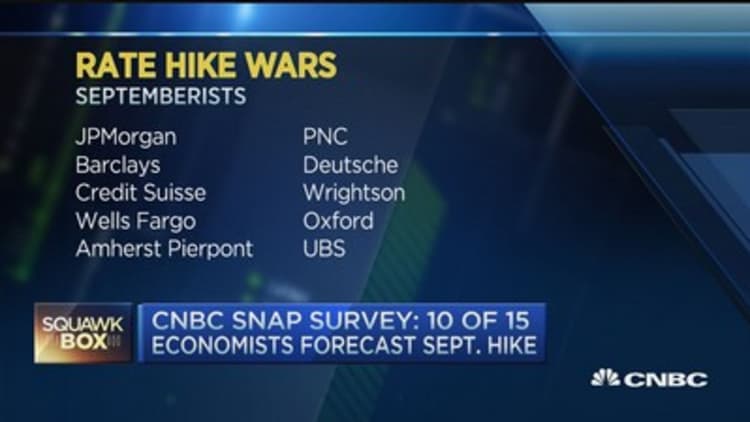

Highlighting the Fed's most glaring problems of "pretty awful international data," the fragility of the market, a lack of complete confidence in its models, and worries that the dollar could become too divergent from other currencies, El-Erian said he understood why The Fed has become so "wishy-washy." However, he agreed a shift away from market-supportive policies could spark a nightmare scenario.

Read MoreThe Fed rate hike speculation is getting crazy

"Prices are up here for risk assets, fundamentals are down here and the difference is enormous trust in central banks," he said. "Markets view central banks as their best friends. So if that paradigm is shaken—if it turns out central banks do not have as much ammunition—then yes, we are going to see valuations come down to fundamentals."

El-Erian predicted the aftermath of that adjustment would create opportunities down the road in the very space he previously avoided. Advocating a barbell strategy, El-Erian had advised investors maintain optionality by holding cash and only some high-risk exposure, but to be mindful of the belly of the curve.

"Now what's going to reprice is the belly of the curve and that is where the opportunities are going to exist," he said. "For now they are relative, but if this continues there will be some absolute beta opportunities right in the belly of the curve."

While El-Erian did not explicitly call whether a rate hike would be coming in September during the interview he admitted it would have been easier for the Fed to do so sooner.

"Now the international data is pretty scary and therefore the Fed has lost the opportunity when it had some alignment."