Here's some bad news for those sniffing out a bargain in stocks: even after a horrendous week, the market is still trading at an elevated valuation by historical standards.

The slid 5.8 percent in the past week for its worst week since September 2011, taking the large-cap index negative over the past year.

That has some looking to buy. On Friday, Kevin Landis of Firsthand Capital Management said that "all you can do now is try to take advantage of it—take a deep breath, take a look at the lay of the land, and you're going to be glad you did six months from now."

Similarly, Bob Doll of Nuveen Asset Management said Friday that "If you've been one of these people that's been on the sideline as many have waiting, waiting, waiting to put some money in—for goodness sake take advantage and put some money in."

Market in panic mode, correction not over yet: Doll

But there's a problem with getting into stocks based on the premise that the recent slide is creating an attractive value proposition.

At Friday's close, the S&P 500 traded at 16.1 times analysts' estimates of the earnings that companies will report over the next year, according to FactSet. This metric, known as the market's forward price-to-earnings ratio, has indeed fallen over the past five months. But it is still well above its ten-year average of around 14.

The backward looking last-twelve-months P/E ratio, which compares current prices to the earnings companies actually reported, is sitting at 17.5. Like the forward P/E ratio, that's not only above historical averages, but above where it was a year ago, per FactSet.

"That strikes me as high," commented David Blitzer, chairman of the S&P Dow Jones Index Committee. "We're in a situation where the valuation does get worrisome, especially since there have been questions about U.S. earnings," given concerns around China and the rest of the emerging markets.

"Some kind of a correction was due," he told CNBC in a phone interview.

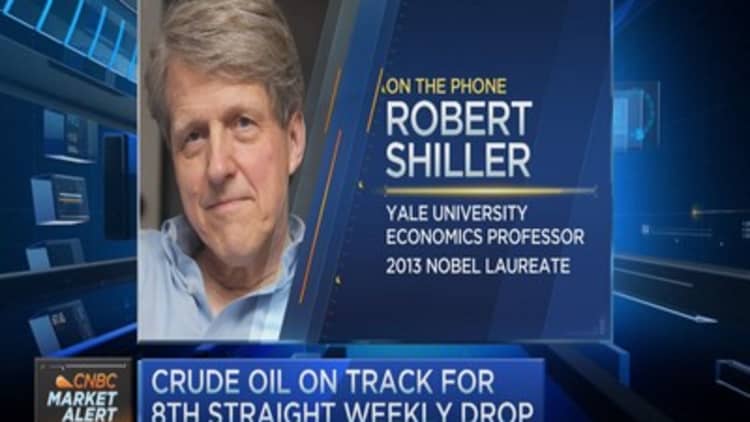

The most famous minder of valuations, Robert Shiller, said Friday morning on CNBC that "valuations are high, quite high by historical standards. It's only been a few other episodes in U.S. history when they've been this high."

Shiller's reference point for valuations is not the forward P/E ratio, but his "cyclically adjusted price-to-earnings ratio," which compares current prices to the last ten years of earnings. Thanks in part to the low earnings engendered by the recession, that ratio remains at sharply elevated levels compared to history.

While the Yale professor and Nobel laureate economist noted that it's impossible hard to make a short-term market call on valuations, he ventured that when it comes to the likely direction of the next move, "I have a general bias towards down, because the market is overpriced."

Market 'aftershocks' are coming: Robert Shiller

"The market's thinking more about macro as opposed to whether valuations are high or low or whatever," commented Curtis Holden, senior investment officer at Houston-based Tanglewood Wealth Management. "We certainly haven't seen enough of a correction yet that you can broadly say stocks are cheap. But even if they were, that wouldn't assure that they won't fall further."

Even some who remain bullish amid the selling, like Louis Abel of Irvine, California-based wealth management firm First Foundation Advisors, say that current valuations are leading them to overweight certain types stocks at the expensive of others.

"The stock market is expensive, but not egregiously overvalued. Valuations don't suggest that we're about to fall off of a cliff. But they do lead us to focus on mega-cap high-quality stocks at the expensive of small-caps and momentum-oriented social media and biotech names," Abel said in a Friday afternoon interview.

So if valuations don't provide a compelling reason to get in, does Monday threaten to bring further losses?

"I think the relevant phrase is that it's too late to sell—but certainly too early to buy," S&P's Blitzer said. "Sometimes what happens is that after a drop like this is that people worry themselves sick the entire weekend, and then they come in early and they sell."

Blitzer's example of this is a particularly scary one for the bulls: Monday, October 19, 1987—the date better known as "Black Monday."

That session, in which the Dow Jones Industrial Average lost 22.6 percent of its value, was preceded by a Thursday drop of 3.8 percent and a Friday decline of 2.4 percent.

—By CNBC's Alex Rosenberg.

Watch "Futures Now" Tuesdays & Thursdays 1 p.m. ET exclusively on FuturesNow.CNBC.com!