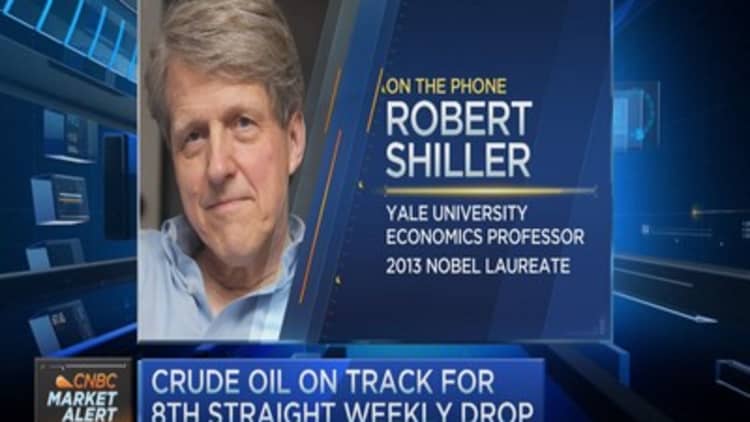

Nobel Prize-winning economist Robert Shiller has warned for months against being overexposed in an overheated market.

And with the major U.S. averages pacing to cap their worst week of the year Friday, it certainly appears to be a well-timed caution, but Shiller isn't saying it's over yet.

"It could be followed by even bigger and bigger moves," he told CNBC's "Squawk on the Street" in an interview. "I have a general bias towards down because the market is overpriced, but these things unfold over years."

While Shiller conceded the possibility that the selloff could "create aftershocks in either direction in the short-term," he highlighted a psychological bias for those in the periphery to "over focus on the latest news."

"When people who don't normally pay attention to the market are brought in, it can feed on itself like an epidemic," he said.

With a long-term view in mind, however, Shiller reminded investors a correction would not be the end of the world, citing confidence China would see renewed growth and the comeback of a healthy U.S. housing market.

Read MoreRelax we're about to hit bottom in stocks: Analyst

"The housing market has been going up at a good clip," he said, adding that some markets might be growing too quickly.

"There's some bubble mentality going on in some places, like San Fran for example."