U.S. stocks closed lower Monday as investors weighed mostly negative stock performance overseas and eyed the Federal Reserve meeting later in the week. (Tweet This)

"I think this is just marking time," said Marc Chaikin, CEO of Chaikin Analytics. He noted a lack of liquidity because "you do have a lot of traders out because of the Jewish New Year."

The Dow Jones industrial average traded in its narrowest range since Aug. 18. The average daily point range for the Dow since Aug. 18 is about 405 points.

Major averages one-day performance

"The data's still light here. We're going to be in wait-and-see mode until we hear from (Fed Chair) Janet Yellen Thursday," said Nick Raich.

The Federal Open Market Committee is scheduled to meet Wednesday and Thursday and could raise short-term interest rates for the first time in more than nine years.

The major averages opened a touch higher but failed hold slight gains. The Dow closed about 60 points lower after briefly falling 100 points.

Apple led blue chip advancers with a gain of 0.95 percent amid positive reports on new iPhone demand. IBM was the greatest negative weight on the blue chip index and closed down 1.2 percent.

Read MoreWith just days to go, Fed hike still a close call

"I don't think anything has changed," said Bruce Bittles, chief investment strategist at RW Baird. He's watching to see if the S&P 500 holds the 1,950 level.

"That China situation is ongoing and continues to weigh on the market. The big question if the Fed does raise rates is the potential turmoil in the global markets," he said.

Materials closed down nearly 1.3 percent as the greatest decliner in the S&P 500.

The energy sector ended down 0.80 percent, the second greatest laggard in the S&P, as oil traded lower after weaker-than-expected Chinese data increased slowing demand concerns. On Friday, Goldman Sachs lowered its forecasts and said crude could fall to $20 a barrel.

Crude oil futures settled down 63 cents, or 1.41 percent, at $44.00 a barrel on Monday.

No major U.S. economic releases or earnings were due Monday. The week's key data scheduled for release included retail sales and industrial output for August on Tuesday.

Treasury yields traded mixed, with the 10-year yield lower near 2.18 percent and the higher around 0.72 percent.

"The bond market is relatively contained today. We are in a wait-and-see mode concerning the Fed this week," said Erik Schiller, head of developed market interest rates for Prudential Fixed Income's multi-sector and liquidity team. "The Fed is the number one event this week. We also have retail sales (Tuesday) that could drive direction."

The U.S. dollar traded a touch higher against major world currencies, with the euro near $1.13 and the yen at 120 yen against the greenback.

"I think we're headed for a volatile week, even though today the indices aren't much of anything," said Peter Cardillo, chief market economist at Rockwell Global Capital. "I expect as the day matures we'll see the indices move in both directions."

Cardillo also expects volatility ahead of Friday's options expirations.

The major averages ended last week more than 2 percent higher, with the Dow Jones industrial average posting its best week since the one ended March 20. The S&P 500 and the Nasdaq composite had their best weeks since the one ended July 17.

European stocks closed narrowly mixed on Monday, following declines in Asian stocks.

The Shanghai Composite plunged 2.67 percent Monday amid weaker-than-expected August reports on investment and factory output that added to concerns of significant slowdown in the world's second-largest economy. However, the official retail sales numbers topped expectations, showing a 10.8 percent increase from the same month last year.

Chinese officials also said Monday that Beijing will work to reform large state-owned companies.

"These can't come as much of a surprise at this stage as Chinese data gradually reflects the well-known reality of a slower economy. More important, however, will be the ability of the Chinese authorities to maintain stability in their stock market and exchange rate and convince markets of their determination to reignite growth," JPMorgan Funds Chief Global Strategist David Kelly said in a note.

"Investors will also be looking at Japan's Tankan index and various measures of economic health from Europe," he said. "However, most of the world's attention will be focused on what the Fed does on Thursday and how it explains its actions or inaction."

The Hang Seng closed up 0.27 percent, while the Nikkei ended down 1.63 percent.

Major U.S. Indexes

In corporate news:

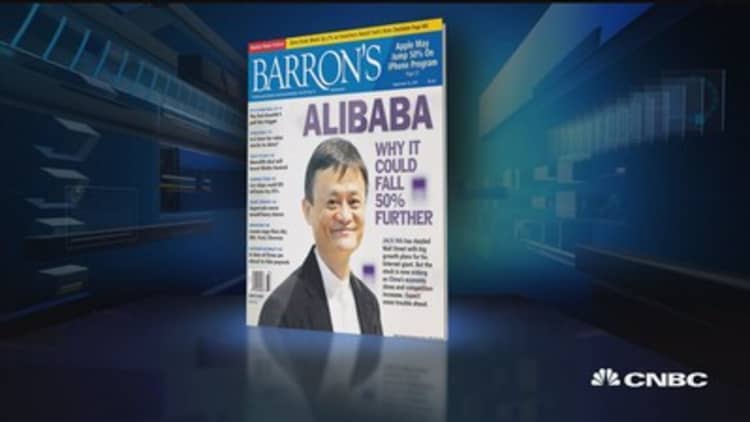

Alibaba — Barron's cover story said the stock could plunge 50 percent from current levels based on its price-to-earnings ratio with other tech companies, market share, and other factors. The Chinese e-commerce giant responded with a letter on its website outlining what it considered inconsistencies in the article's analysis. The stock closed down 3.1 percent.

Read MoreAlibaba warned there was trouble before Barron's

Apple — Pre-order demand for the iPhone 6s and 6s Plus on their first day of availability was stronger in China than most regions, according to early reports. The company said in a statement it is "on pace to beat last year's 10 million unit first-weekend record when the new iPhones go on sale Sept. 25."

Read More Early movers: BABA, SLH, AAPL, MRVL, FCAU, HRB, FB, GOOG & more

The Dow Jones Industrial Average closed down 62.13 points, or 0.38 percent, at 16,370.96, with Cisco leading decliners and Apple leading a handful of advancers.

The closed down 8.02 points, or 0.41 percent, at 1,953.03, with materials leading nine sectors lower and utilities the only advancer.

The Nasdaq closed down 16.58 points, or 0.34 percent, at 4,805.76. The iShares Nasdaq Biotechnology ETF (IBB) briefly fell more than 1 percent.

The CBOE Volatility Index (VIX), widely considered the best gauge of fear in the market, traded near 24.

About two stocks declined for every advancer on the New York Stock Exchange, with an exchange volume of 683 million and a composite volume of 2.9 billion in the close.

Gold futures settled up $4.40 at $1,107.70 an ounce.

—CNBC's Robert Hum contributed to this report.

On tap this week:

Tuesday

8:30 a.m.: Retail sales

8:30 a.m.: Empire state survey

9:15 a.m.: Industrial production

10 a.m.: Business inventories

Wednesday

FOMC meeting begins

8:30 a.m.: CPI

10 a.m.: NAHB survey

4 p.m.: TIC data

Thursday

Final day of FOMC meeting

8:30 a.m.: Initial claims

8:30 a.m.: Housing starts

8:30 a.m.: Current account

10 a.m.: Philadelphia Fed survey

2 p.m.: Fed statement

2:30 p.m.: Fed Chair Janet Yellen news briefing

Friday

10 a.m.: Leading indicators

Saturday

1:30 p.m.: San Francisco Fed President John Williams on the economic outlook

3:30 p.m.: St. Louis Fed President James Bullard on the economy and monetary policy

More from CNBC.com: