Jim Cramer was tempted to resurface his "they know nothing" rant after hearing the Fed speak on Wednesday. He was hoping that a few boxes on his market bottom checklist might be checked off, but it seems that the bear market has not yet run its course.

"The Fed's wishy-washy statement on interest rates today left stocks sinking back into oblivion after a nice rally yesterday," the "Mad Money" host said.

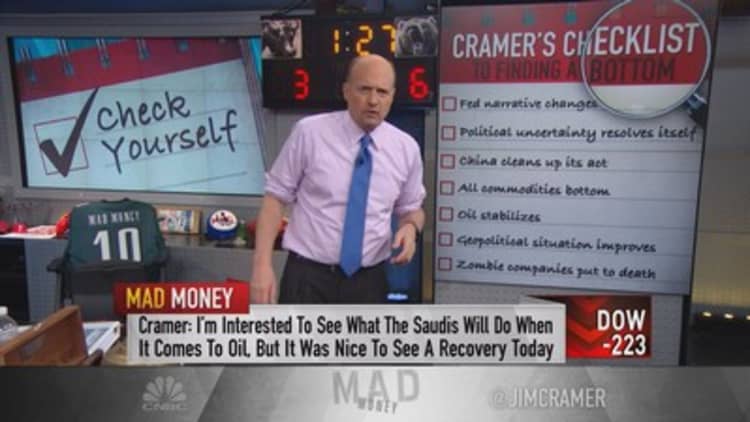

The Fed managed to cause so much damage to stocks, Cramer decided to go down his checklist once again to reiterate what must happen before stocks will stop going down.

I think they will be proven wrong on both counts. Box not checked.Jim Cramer

First on his checklist was the Fed. Cramer wanted to hear a better narrative from the Federal Reserve other than the confirmation that it will continue to raise rates at a gradual pace because it is worried about inflation.

This means investors must wait until the next meeting in March to find out what will happen. And if jobless claims spike again on Thursday, Cramer will be even more interested to know if the Fed will be ready to tighten again.

Cramer thought the Fed's statement was very hawkish, meaning that it thinks inflation could be a huge problem even though there has been a massive decline in oil prices and there hasn't been an increase in hiring.

"I think they will be proven wrong on both counts. Box not checked," Cramer said.

Read more from Mad Money with Jim Cramer

Cramer Remix: What Apple should buy next

Cramer: Buy the railroads if the Fed says this...

Cramer: Charts predict S&P bounce will end soon

Cramer is also interested in seeing an end to political uncertainty in the U.S. Regardless of his political views; it seems to him that all of the leading presidential candidates agree on policies that are bad for financials and the drug companies. The uncertainty has only become worse since he created this checklist.

Another item on his checklist was that Cramer was hoping to see the strong dollar weaken. But after hearing Apple, Johnson & Johnson and 3M report he knew the situation had only become worse since the Fed tightened in September.

Additionally, there are too many peaks in this market. Cramer continues to believe that autos have topped out, along with housing and cellphones — and Apple did nothing to change his mind about that.

Cramer also wanted to see technology leadership outside of FANG — his acronym for Facebook, Amazon, Netflix and Alphabet — and that has not happened. The stocks were all crushed on Wednesday, but no leader has stepped forward to replace them.

So, after another down day in the market, Cramer found way too many boxes still remained unchecked. He recommended investors keep some cash on the sidelines and don't get too excited.

"Just when we thought the Fed could do the job, they let us down again. We are back into a world of hurt until we can start checking off these darned boxes," Cramer said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com