The liquefied natural gas market (LNG) has a big problem: supply of the commodity is expected to outstrip demand for rest of the decade, said an analyst Wednesday.

The mismatch—bumper facilities coming on stream just as large buyers such as Japan are weaning away from LNG—casts doubts over one of the biggest alternative fuel stories in the past five years. Natural gas prices have already cratered to 17-year lows of around $1.70 per million British thermal units (mmBtu).

"Whereas there will be the supply response and ongoing strength in demand coming through for oil… there isn't necessarily the same amount of demand growth coming through for LNG while we are getting bombarded with LNG supply coming into the market because these projects take a much longer time to come to fruition," said Matt Smith, director of commodity research at New York-based ClipperData, a data company.

Supply has picked up pace recently.

The U.S. exported its first cargo of shale LNG from Sabine Pass on February 24 while energy giant Chevron is planning to ship its first cargo from its massive $54 billion Gorgon Project in Australia next week.

Despite concerns over the health of the LNG market, Chevron chief executive John Watson told CNBC Tuesday that it is upbeat about the market.

"Prices are under pressure in both oil and gas; natural gas prices in this country are very low, and LNG prices that are on a spot market are low. But we've sold 75 percent of our gas on our two big projects in Australia to oil linked pricing going forward," Watson said.

"As we start to see some strengthening in the oil markets we think that we will be growing production into a rising market," he added, noting that Chevron foresees its Gorgon Project will be profitable in a $40 oil environment.

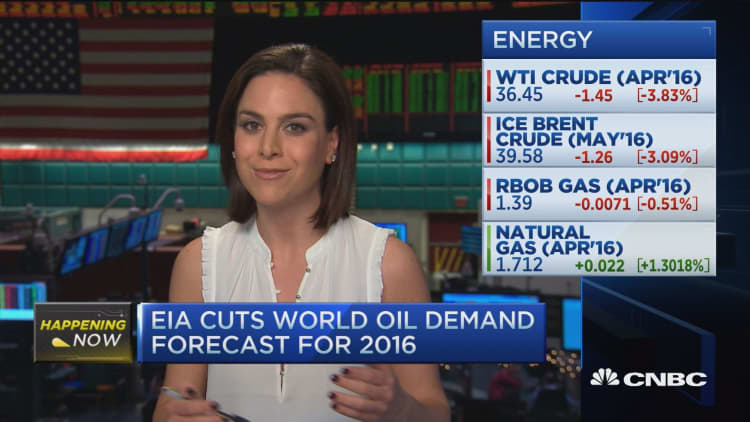

The price of U.S. WTI light sweet crude is flat around $36.50 a barrel while crude is just below $40 a barrel after both grades fell about 3 percent overnight as industry data showed U.S. crude stockpiles grew 4.4 million barrels last week, sending inventories to a record high.

ClipperData's Smith said the outlook for oil is unlikely to be change substantially in the short-term even as Kuwait said on Tuesday that it will freeze output only if all major producers participate.

"Prices rallied in the last few weeks based on expectations that we are going to see some sort of supply impact relating to a production freeze or a supply cut when in reality, nothing has really been agreed upon," he added.

Russia and OPEC countries met in Doha last month to discuss measures to support oil markets and agreed on an output freeze at January levels. Although the move boosted market sentiment, little has been done in reality as Iran has refused to take part in the joint action.

"(What Kuwait said) is the same thing that we've heard from Saudi Arabia etc., so really it's just rhetoric at the moment."