It was a week of extremes for Jim Cramer, with stocks ending each day a champion or a loser.

And it all came down to oil as the catalyst for the rally.

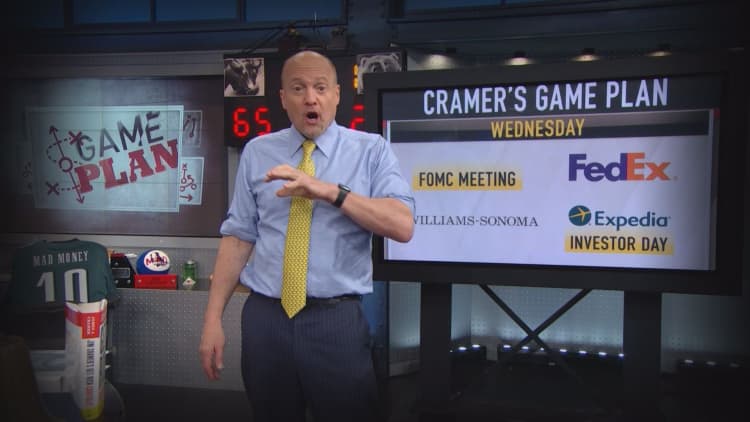

"The Fed speaks Wednesday, and I am concerned that with oil coming back, the Fed has lost the principal reason why it could keep rates down," the "Mad Money" host said.

The Fed is fearful of inflation, in Cramer's opinion, and if wages continue to be stagnant he would not be surprised to hear a negative statement from the Fed but not an actual rate hike. In fact, the market could be too bullish on oil right now.

The golden price of oil for Cramer is the one that brings equilibrium. That's the price that allows oil companies to stay afloat, without taking down the banks that lent to them, and yet allows the consumer to save money at the gas pump.

In addition to the Fed, one event that Cramer will be watching next week is the analyst meeting for CBS. He cannot wait to see what CEO Les Moonves has to say. As usual, he might just make investors wish that they owned the stock. So, the trade of the week could be buying CBS into its analyst day.

Cramer is officially calling the recent run in crude the "great Goldman Sachs oil rally."

On Friday, Goldman raised the low end of its predictive range for oil to $25 from $20, which signaled to Cramer that the credit crunch could finally be over.

"When the biggest — and most correct — bear says that perhaps the bottom has been put in, that is good enough to spark a rally that makes it so the largest real worry out there gets taken off the table," the "Mad Money" host said.

Goldman's call made sense to Cramer because of the combination of oil companies accessing equity markets for cash, rising demand for gasoline and cancellation of oil projects were great signals.

Read More Cramer: Oil's biggest worry now off the table

With the market roaring higher and the price of oil once again on the rise, Cramer decided to circle back to NRG Energy, a stock that lost 56 percent of its value last year.

"You don't normally see that kind of a decline in a staid utility stock, because the utilities tend to be a predictable, slow and steady business," the "Mad Money" host said.

What the heck went wrong?

NRG Energy is the owner of the largest fleet of power plants in the U.S., with a sizeable alternative energy business. After delivering solid performance from 2012 to the first half of 2014, the stock stalled out and then went into free-fall.

"It is very simple, the bottom line is that owning a utility stock should never be this fraught," Cramer said.

Investors should not have to worry how a company is spending its money or if a dividend will be slashed. So, for those looking for a utility play, Cramer said stay away from NRG Energy and go with something more reliable like American Electric Power or Con Ed. And for solar, stick with First Solar.

With earnings season in the rearview mirror, Cramer was ready to crown the winners of the restaurant and retailers.

"What really strikes me is that we have seen an incredible range of results from the retailers and restaurants, everything from terrible quarters to extremely impressive ones," Cramer said.

Three retail companies that reported significantly better quarters than expected were JC Penney, Home Depot and Urban Outfitters. In the restaurant space, the winners were Panera Bread, Domino's Pizza and Darden.

But it was the earnings from Ulta Salon that shocked Wall Street after reporting a fantastic quarter on Thursday. Cramer has been a believer in this stock for ages, even as a monster sell-off in February took the stock down to $152 from $181 in a matter of days.

How could investors have been so wrong about it?

"Honestly, this was totally gettable if you just watched the show and listened to what Ulta's CEO Mary Dillon has had to say," Cramer said.

The truth is, Cramer said, Ulta is doing amazingly well. Bearish short-sellers were clearly ill-advised back in February, and he doesn't think it is done roaring, yet.

In the Lightning Round, Cramer gave his take on a few caller-favorite stocks:

Cummins Inc: "It's back over $100. I love the company so much, but I'm going to ask for you to wait for a pullback to back under $100 before you pull the trigger."

Twitter: "I have a small position for my charitable trust. I have very little confidence that this quarter is going to be that good. I'm not seeing growth there. Longer term, I think someone will figure something out."