It was a week of extremes for Jim Cramer, with stocks ending each day a champion or a loser.

And it all came down to oil as the catalyst for the rally.

"The Fed speaks Wednesday, and I am concerned that with oil coming back, the Fed has lost the principal reason why it could keep rates down," the "Mad Money" host said.

The Fed is fearful of inflation, in Cramer's opinion, and if wages continue to be stagnant he would not be surprised to hear a negative statement from the Fed but not an actual rate hike. In fact, the market could be too bullish on oil right now.

The golden price of oil for Cramer is the one that brings equilibrium. That's the price that allows oil companies to stay afloat, without taking down the banks that lent to them, and yet allows the consumer to save money at the gas pump.

With this in mind, Cramer shared the stocks and events he will be watching next week:

I am concerned that with oil coming back, the Fed has lost the principal reason why it could keep rates down.Jim Cramer

Monday: TravelCenters of America, 3D Systems

TravelCenters of America: Normally Cramer wouldn't be watching this stock, but since it has strong involvement with gas stations along interstates, it has significant weight on his theory that oil may have bottomed and there is an increased use of gasoline.

Read more from Mad Money with Jim Cramer

Cramer Remix: This stock will be up big

Cramer: Stop being a herd animal! Top 3 lessons

Cramer: Earnings that shocked rich Wall Street

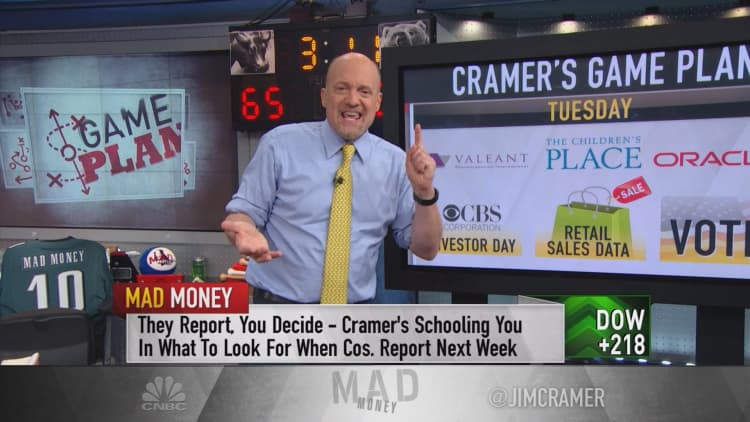

Tuesday: Valeant, Children's Place, Oracle, CBS analyst meeting, retail sales, Super Tuesday

Oracle: With the stock trading at just 15 times earnings, Cramer considers it to be a cheap — but that doesn't make him a buyer.

"I just lack a catalyst to get behind it because it hasn't been able to blow the numbers away for ages," Cramer said.

CBS analyst meeting: Cramer cannot wait to see what CEO Les Moonves has to say. As usual, he might just make investors wish that they owned the stock. So, the trade of the week could be buying CBS into its analyst day.

Retail sales: Back in January, one of the numbers that allowed the market to rebound was the retail sales figure, which came in stronger than expected. If the numbers are strong again, Cramer is willing to bet that Tuesday could be a rough day on the averages as many commentators will fear that the Fed will tighten on retail strength.

Super Tuesday: With yet another Super Tuesday in the political atmosphere, Cramer thinks Donald Trump could win again. He wants investors to be ready for serious protectionist rhetoric and China bashing that could cause trading anxiety.

Wednesday: Federal open market committee meeting, FedEx, Williams-Sonoma, Expedia

FedEx: Considered by Cramer to be the epicenter of global commerce, this is one of the last stocks that could impact trading with the company's tendency to be very positive or negative about world trade. Unless FedEx confirms that business is accelerating, a 20 point rally from the bottom seems possible.

Thursday: Adobe

Adobe: The tech world was crushed last month when LinkedIn and Tableau Software reported disappointing numbers. This affected the stock of Adobe, which was a huge mistake in Cramer's opinion. He expects to hear good things from Adobe.

Friday: Tiffany & Co

Tiffany: Cramer is worried about retail, and he hopes his fears are not confirmed by Tiffany's report. This company has become an over-promiser and under-deliverer in the past, but this time it lowered expectations to the point where Cramer thinks it could actually beat.

"If Tiffany fails this time, I am tempted to break out the wall of shame," Cramer said. (Tweet This)

Ultimately, it will be the Fed that investors will be thinking about next week. If it does not make a move, Cramer expects that will trigger a fifth good week in a row for stocks. But if it discusses rate hikes or announces one — expect a big repeal.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com