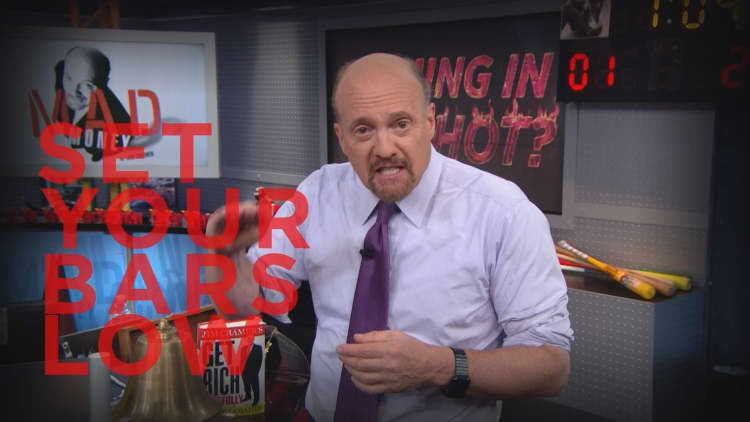

It's never a good thing for the stock market to go in hot into earnings season, Jim Cramer says.

"We want things cool. There is too much heat. That is why I'm hoping we get some more down days this week, just in case the earnings aren't as perfect as they need to be after this historic run," the "Mad Money" host said.

Looking at the overall context of the market, Cramer wasn't impressed. In fact, he thinks that is the major reason why the Dow failed to hit 20,000 again.

Cramer was especially worried about technology, even Apple, which was anointed as a top pick by Morgan Stanley because of the impending iPhone 8 and the possibility of repatriation relief.

"I much prefer downbeat talk that keeps expectations low," Cramer said.

That is why moving into earnings season, Cramer is hoping for more downgrades and negativity in the stock market in general. More sell ratings could create much-needed pessimism to cool stocks down.

While the market continues to focus on whether the Dow Jones industrial average will hit 20,000, Cramer would rather look at how conceivable it is for the Dow to keep running after it does.

Good news is that he does think it is possible.

"When you look at how far stocks would need to rally to get back to their all-time highs, you will find that many of these Dow names have been much higher in less fortuitous circumstances," Cramer said.

Cramer boiled it down to 12 encouraging stocks that must advance more than 10 percent to get back to their old highs.

Cramer has always said that the humanization of pets is one of the greatest investing themes out there. But he still didn't see it coming when privately held food giant Mars paid a huge premium for Veterinary Centers of America, known as VCA.

VCA shareholders received a 31 percent gain on Monday with Mars' $7.7 billion bid. Mars plans to pair the business with its Banfield pet hospital chain to create a dominant health care company for companion animals.

However, Cramer warned that this doesn't mean the rest of the pet players could have the same fortune.

"I don't think the other companies in the space are takeover targets, although I do think that Idexx can work its way higher over time," Cramer said,

Johnson Controls has also undergone a huge transformation from where it was a year ago.

The diversified industrial company closed on its massive merger with Tyco in September, which gave it exposure to security and safety. This was also a tax inversion deal that Johnson Controls to change its domicile to Ireland.

In November, the company spun off its automotive seating business as a separate company called Adient. Cramer spoke with CEO Alex Molinaroli, to find out could be ahead for 2017.

"When I look at our future, and you look at where we are with building controls, fire alarms, security systems; you can't get anything but excited about that. When you look at the end markets and what is going to happen, it's pretty exciting," Molinaroli said.

Adient began trading as an independent company a little over two months ago. Since that time the stock has skyrocketed up more than 24 percent.

However, with 32 percent of its sales coming from China, Cramer worried that Trump's view of trade with China could hurt the stock. In fact, Adient has 44 percent market share when it comes to Chinese car seats.

Adient could also be hurt by a strengthening dollar, Cramer said. Nevertheless, with the stock at such a cheap level, he thinks the negatives are already baked in and the potential positives aren't.

"This is a classic example of why I love break-ups," Cramer said. "And even when you consider that Adient is almost the quintessential non-Trump stock, I think it's too cheap to be ignored."

In the Lightning Round, Cramer gave his take on a few caller favorite stocks:

EQT Midstream Partners: "I like EQT but I prefer Magellan Midstream. My charitable trust owns that one. I feel more confident about the earnings power."

Hormel Foods Corp: "I like Hormel long term because of changes that they are making to be more and organic. But remember, in a Trump rally, it's not a Trump stock."