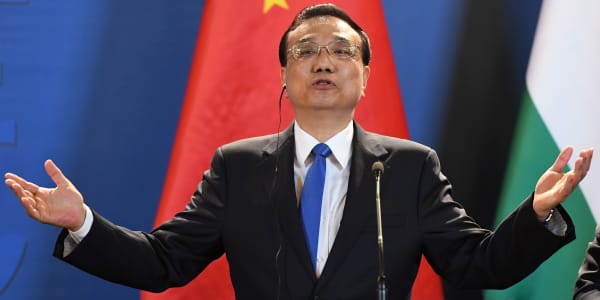

China is sending a "remarkably strong signal" about stemming capital outflows by going after big companies, said Eswar Prasad, the former head of the IMF's China division.

"I think there is a concern here that corporate outflows, among other types of outflows, may be providing a cover for the illegitimate capital outflows, the capital flight that the government is concerned about," Prasad, who is currently a senior professor of trade policy at Cornell University, told CNBC's "Squawk Box" on Wednesday.

"I think this is a very clear signal that they intend to maintain very tight control of the capital account and even so-called legitimate flows are going to be under scrutiny for a while."

Prasad was speaking on the sidelines of the World Economic Forum's "Summer Davos" event in Dalian, China.

China has struggled with capital outflows in recent years, with its foreign reserves dropping from a peak of $3.99 trillion in June 2014 to below $3 trillion in February as the central bank intervened to prop up . There has been modest improvement since; foreign exchange reserved climbed to a seven-month high of $3.054 trillion in May, according to a Reuters report.

China has increased its already-strict capital controls in efforts to keep more money onshore, especially as Chinese firms went on a massive overseas shopping spree. All that money fleeing China added further strain to the economy — and more downward pressure to the yuan.

This month, regulators have upped their game on examining how top Chinese companies such as conglomerate Wanda and insurer Anbang have borrowed money, and how they've structured massive deals, such as snapping up marquee assets from Legendary Entertainment to the Waldorf Astoria hotel.

The crackdown also represented a "paradox" with some of the government's other goals, Prasad noted.

"On the one hand, the Chinese government, I suspect, still wants the right sort of corporate outflows. It loves technology transfers from the rest of the world and the acquiring of managerial and other sorts of technical expertise," he said. "But I think right now, the prerogative of trying to manage the capital outflows is taking precedence."

Prasad also pointed to concerns about corporate China's growing debt pile.

In a note on Monday, Nomura estimated that China's outstanding non-financial sector debt hit 191.3 trillion yuan ($27.96 trillion), or 251 percent of gross domestic product (GDP) in the first quarter, up from 158.3 trillion yuan, or 231 percent of GDP, at the end of 2015.

"Some of these companies have not only been using domestic leverage, but also trying to increase their profile abroad," Prasad said, noting authorities' concerns over rising domestic debt.

"I think the notion of some of these companies becoming too big for their britches and also adding to both domestic risks of their leverage build up and capital outflows may all be leading to a confluence of issues that led to this crackdown," he said.

In a recent paper, the IMF said that corporate credit growth in China has been "excessive." But "investment efficiency has fallen, and the financial performance of corporates has deteriorated steadily, affecting asset quality in financial institutions," IMF researchers wrote.

—CNBC's Sophia Yan contributed to this article.