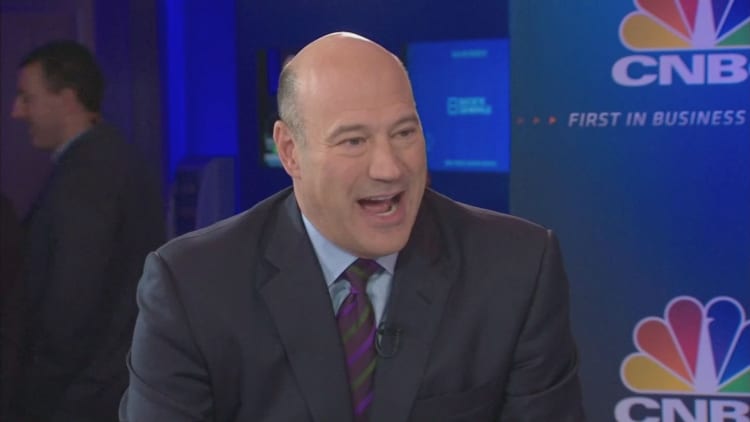

Let me respectfully disagree with my colleague, Jim Cramer, who said Wednesday morning that should Gary Cohn become chairman of the Federal Reserve, he would "spot the bulls 5 percent."

If Cohn, currently head of President Donald Trump's National Economic Council, becomes Fed chair, I would spot the bears 10 to 20 percent.

It's clear from the reporting in Politico and from CNBC, that Janet Yellen's days as head of the Fed may be numbered. But turning to an ex-commodity trader to run the Fed is like turning to a gambling addict to run a casino.

Yes, it takes discipline to trade commodities and a sharp, street-savvy mind. But it takes much more to run the most powerful and impactful central bank in the world than it does to run a trading desk at Goldman Sachs.

True, Cohn was also promoted a number of times until he reached the second-highest position at Goldman, but Robert Rubin he ain't.

Rubin, another Goldman alum, had not just a trading and management background, but also a set of operating principals and a fundamental economic philosophy that made him one of the best Treasury secretaries the U.S. has had since Alexander Hamilton.

Rubin could also have served as Fed head, but, to my knowledge, he never wanted the job.

Cohn, on the other hand, has neither the academic background, nor the macro-economic skills, normally associated with setting monetary policy.

I say this with no particular animus, as I have never met the man. But I also would not put him at the top of my list to replace Yellen.

Like FDR, Trump is about to pack the under-staffed Fed with loyalists and Wall Streeters, a combination that could result in market-friendly policies in the short run, but that ultimately lead to much looser regulations and unstable markets in the long run.

And while the economist John Maynard Keynes said that in the long-run "we are all dead," there is no reason to speed that process along by having a competent, but not fully qualified, head of the Fed.

Granted, when compared to other Trump appointees, Cohn may be a breath of fresh air. But he lacks the breadth and depth needed to confront the policy challenges that central bankers who play three-dimensional chess with the world's largest economy confront every hour of every day.

Yellen's economic report to Congress, the first part of which she delivered Wednesday, displays the deliberative effort required in setting interest rate policy.

Rate hikes may be nearing an end, while balance-sheet reductions are just beginning.

More specifically, Yellen indicated that the so-called terminal rate in this rate-hiking cycle may be much lower than in previous periods. In other words, the Fed Funds rate may top out at 2 percent, rather than the 4 percent peak we have seen in prior cycles.

The process of normalizing interest rates is being executed in a thoughtful and careful manner.

That is being reflected in the stock market today. If it ain't broke, don't fix it, even if the potential "fixer" plays for your team, rather than your predecessor's.

Bill Clinton kept Alan Greenspan. George W. Bush did, as well, and then appointed Ben Bernanke, who was kept in place by Barack Obama.

Managing the Fed is a team sport, but the only team the chairman is supposed to manage is the one that requires independence from the branch that picks the manager.

Cohn's management style is said to be somewhat similar to Trump's … bare-knuckled and brash.

If there's one thing that this administration can learn from itself, and from prior administrations, is that shooting from the lip can be costly.

I'd rather have a Dimon in the rough atop the Fed than have Gary mint the Cohn of the Realm.