The U.S. exchange-traded fund that tracks South Korean stocks erased gains and fell nearly 1 percent Tuesday amid fears of an escalating North Korea nuclear threat.

The South Korean stocks ETF then fell to session lows in the afternoon after President Donald Trump said the U.S. would react strongly to any North Korean threats.

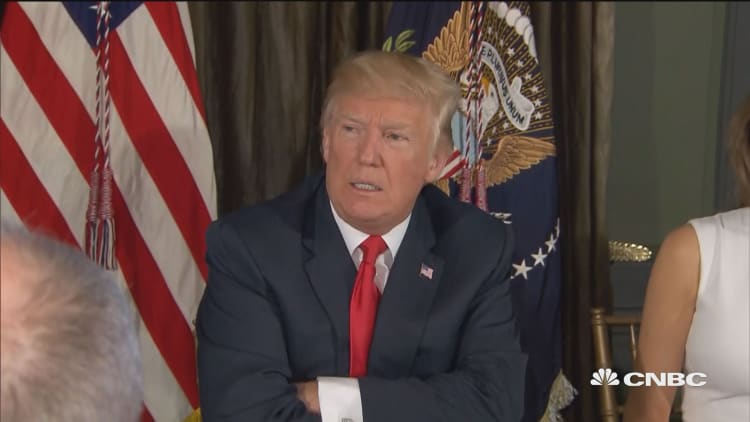

"They will be met with fire and fury like the world has never seen," Trump said.

Earlier, the iShares MSCI South Korea Capped ETF (EWY) erased a 0.1 percent gain after a report said North Korea can now fit nuclear weapons into missiles. EWY closed 0.85 percent lower, slightly off session lows.

iShares MSCI South Korea ETF (EWY), 1 day

"Trump needs to learn the value of silence," Robert Manning, senior fellow at think tank Atlantic Council, said in an email to CNBC. "It only ratchets up tensions unnecessarily to play this dumb tit-for-tat rhetorical game with North Korea."

Manning said Trump should have simply stated that any use of weapons of mass destruction by North Korea "will result in a swift and overwhelming U.S. response that will be the end of North Korea. He should leave it at that. Where are the grown-ups?"

The Washington Post first reported the nuclear weapon news, sparking the dive in the EWY, and the report was later confirmed by NBC News. The report comes less than two weeks after the North Korean government tested an intercontinental ballistic missile that could reach as far as New York.

"Korean asset markets have performed strongly this year, but are starting to look more fragile," said Callum Henderson, an analyst at Eurasia Group, in a note Monday.

The EWY and the Kospi index, South Korea's benchmark stock index, have handily outperformed the S&P 500 this year, advancing 29.3 percent and 18.2 percent respectively. The , meanwhile, has risen 10.6 percent.

The ETF's largest holdings include Samsung Electronics, SK Hynix and Posco.

Henderson also pointed out that South Korea's currency, the , has been the worst-performer in Asia against the dollar since July 21. In that time period, the won has fallen 0.8 percent against the greenback.

The Dow Jones industrial average also fell to its low for the day after the Trump comments.

— CNBC's Evelyn Cheng contributed to this report.

WATCH: N. Korea will be met with 'fire and fury'