With news of the proxy battle between Procter & Gamble and activist investor Nelson Peltz coming to a close, CNBC's Jim Cramer shared his thoughts on the practice of activism.

"This is very much a case-by-case thing," the "Mad Money" host said. "There are some 'scorched earth' activists who seem to specialize in creating ill will and not much else. But you know what? I think those days are largely behind us, at least when it comes to smart activists who know what they're doing."

1. Procter & Gamble

Procter & Gamble's shareholders voted against Peltz's bid to join the board of directors of the consumer goods giant on Tuesday. The company declared victory before the vote was officially finalized. Peltz said it was a "dead heat."

One of Cramer's favorite companies, Procter & Gamble boasts leading household brands like Tide, Febreze and Gillette. Cramer said management seemed to have lost its way between 2010 and 2015, giving Peltz an opening to step in and push company-wide changes.

But then Procter & Gamble elected longtime employee David Taylor as chairman, president and CEO. Taylor started to cut costs and push research and development initiatives.

While Cramer said Taylor's strategy hasn't been perfect, it helped the company climb out of its five-year rut. But Peltz, backed by his firm, Trian Partners, insisted there was more to be done.

In a 94-page white paper, Peltz publicly called for more accountability among Procter & Gamble's executives and more brand initiatives, requesting a seat on the company's board.

Procter & Gamble pushed back, taking aim at Peltz's tenure at other consumer goods companies. Taylor called Peltz's proposals "very dangerous" for the company in the short and long term, adding that management had already made many of Peltz's suggested changes.

Still, Procter & Gamble's stock stayed intact, an effect Cramer attributed to the heat of the proxy battle. As shares declined in the wake of the vote, Cramer surmised that they would have been rising had Peltz won.

"All that said, the biggest winners here [are] you, the shareholders. Any spur from outside that creates more accountability is always going to be a good thing," Cramer said. "I like that kind of challenge. I feel comfortable enough in my skin to have one, though obviously the board of directors didn't. Still, they would've been better off with him than without him."

2. General Electric

That's why Cramer was elated to see Ed Garden, the co-founder of Trian Partners, awarded a seat on the board of General Electric.

Unlike Procter & Gamble, the industrial conglomerate is outwardly in peril and needs help, Cramer said. Amid a corporate turnover, new CEO John Flannery can now turn to Trian for help reversing the company's blunders, cutting costs and restoring the dividend.

"It's another situation where activism could have done a lot more good if management had just listened in the first place," Cramer said, noting that Trian has owned a stake in General Electric since 2015 and proffered cost-cutting advice long before Flannery took over. "I think the stock would be a heck of lot higher if Trian had been heeded."

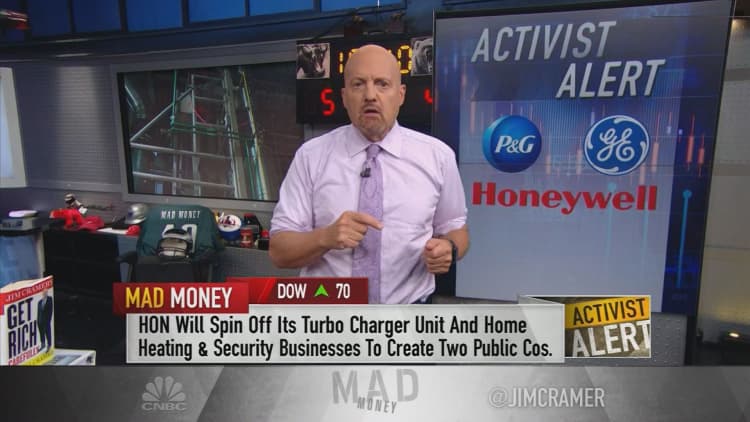

3. Honeywell

Tuesday's activist-related news compounded as reports surfaced that Honeywell, a major industrial, is planning to spin off its non-core assets to create two standalone companies.

The breakup will come at the behest of the company's new President and CEO, Darius Adamczyk, in the first shake-up since he took over in April, sources familiar with the matter told Reuters.

Activist investor Dan Loeb, who runs Third Point, first pushed for Honeywell to shed its aerospace business in late April.

"I think the split will create a ton of value, even as some expressed disappointment," Cramer said. "The disappointment is your buying opportunity, as the breakup here will create two best-in-class companies that don't necessarily belong under one roof."

In an emailed response to CNBC's request for comment, a Honeywell spokesperson shared a quote from Adamczyk:

"We're very excited about these portfolio changes and about the future of Honeywell and where we are headed. These developments are positive for employees and customers, and will create tremendous amounts of value for shareowners."

4. Smith & Nephew

Finally, activist firm Elliott Partners revealed on Tuesday that it has taken a stake in prosthetics maker Smith & Nephew. Cramer saw the development as a promising sign for shareholders.

"This is good news for Smith & Nephew shareholders, as Elliott can put pressure on management to conduct its business in a more rigorous fashion — that's one of the firm's hallmarks," Cramer said. "My charitable trust owns Arconic ... and NXP Semiconductor in part because of the pressure Elliott's putting on both businesses to unlock more value."

Final Thoughts

Overall, whether the investor succeeds or not, Cramer sees activism on Wall Street as a net-positive for companies, particularly those with businesses in need of reform.

"Some of these activists are better than others, but generally speaking, when a smart activist like a Peltz or a [Elliott Management's Paul] Singer gets involved, it's a good thing for you at home. Even when the activists fail to get everything they want, you, as a shareholder, should be grateful for their work. Believe me, these stocks, many of these, would be even lower, maybe much lower, without the pressure these funds put on management," the "Mad Money" host said.

WATCH: Cramer's thoughts on activist investing

Disclosure: Cramer's charitable trust owns shares of General Electric, Arconic and NXP Semiconductor.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com