President Trump isn't the only one questioning the post office's pricing strategy.

UPS, the shipping giant, has been in a back-and-forth with Amazon in recent years over the post office's cost structure, which has direct impact on how the Postal Service sets its package shipping prices, according to public documents filed with the Postal Regulatory Commission (PRC).

In a February filing, for example, UPS called the post office's cost distribution "puzzling," to which Amazon responded in a separate filing that UPS offers "no evidence" of inconsistencies in the current system.

Though obscure, the issue impacts what Amazon — which relies heavily on the post office — pays for shipping, and could bring a competitive advantage either to the company — or to rivals like UPS.

The dispute primarily centers around how the post office splits its fixed "institutional" costs — such as the driver salaries, trucking fees, and other overhead expenses — between its two businesses: The "Market Dominant" letter business (a government-protected monopoly) and the "Competitive" parcel business (which competes with many private businesses, including UPS and FedEx).

Currently, the post office is required to cover a minimum of 5.5 percent of its fixed costs with revenue from the "Competitive" business. Any increase in the required cost coverage from the Competitive business would theoretically force the post office to raise package shipping prices — because it would need more revenue to pay for those costs. That's not what companies like Amazon want because they heavily rely on the post office to ship their orders.

On the other hand, maintaining the minimum cost coverage ratio makes it harder for other carriers like UPS and FedEx to compete with the post office because it allows the Postal Service to keep prices relatively low. Alongside UPS, FedEx has also expressed concern over the low minimum requirement in a filing last year, though it eventually got rescinded for unknown reasons. (UPS declined to comment. Amazon did not return a request for comment.)

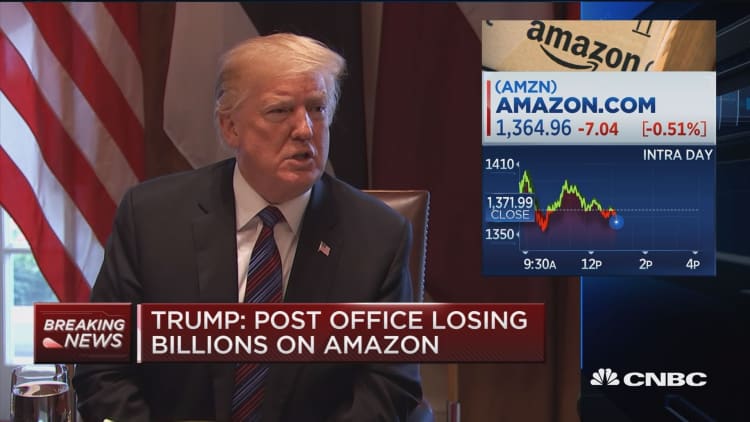

As Trump intensifies his criticism of the post office, deriding it as Amazon's "Delivery Boy" this week, the Postal Service's pricing policy has come under the spotlight. The debate around the cost distribution underscores how some companies view the post office as gaining an unfair advantage over other parcel carriers with a flawed costing methodology — allowing it to essentially cross-subsidize its "competitive" business with the monopoly "market dominant" business.

"UPS makes a reasonable argument that needs to be discussed," said Mark Jamison, a former postmaster of Webster, North Carolina, who has written about this topic for years on the blog "Save the Post Office." "It's worth discussing whether the postal service has the right strategy."

'Fairness' issue

The 5.5 percent minimum share was set in 2006 when the Postal Accountability and Enhancement Act (PAEA) became law. But because the law was written more than a decade ago, it fails to capture the growing mix of package shipments, especially as a result of e-commerce growth, UPS wrote in a filing last year.

The post office has seen a steady increase in revenue from the Competitive packaging business. In 2008, the Competitive business generated just $8.4 billion, or just 11 percent of the total revenue. By 2017, that part of the business had grown to over $19 billion in sales, approximately 30 percent of the post office's total sales.

To better account for this change, UPS thinks the Postal Service's Competitive business should pay a larger share of the fixed costs — approximately 29 percent.

"The current requirement that competitive products must cover 5.5% of institutional costs is so low and outdated that it is effectively meaningless today," UPS wrote in its filing.

Jim Campbell, a lawyer and consultant who's previously worked with carriers like DHL, said this is fundamentally a "fairness" issue. When the post office is involved in both a monopoly and competitive market, it's only fair that the competitive side cover a "reasonable share" of overhead costs, he said. The post office, for example, doesn't pay property and real-estate taxes and is exempt from certain fees like registration fees and parking tickets.

"In order to be fair to the people that are competing in the competitive market, Congress said the PRC has to assign a reasonable proportion of the costs to the competitive products as a whole," Campbell said. "It's fairness to the competitors and the customers."

Amazon, meanwhile, wants to keep the share at 5.5 percent, or even eliminate it entirely. In one of its filings last year, Amazon wrote that the higher minimum would provide "no benefits to mailers, shippers or consumers," and that it's not a necessary requirement to "level the playing field" between the Postal Service and private carriers.

Indeed, the post office has been steadily increasing the cost contribution of Competitive products over the past three years, far exceeding the 5.5 percent minimum requirement. In 2017, it jumped to 23 percent, the PRC disclosed in its annual report last week, up from 2015's 13.3 percent and 2016's 16.5 percent.

Campbell said there are "respectable arguments" on both sides and there's "no perfect answer" given the complexity of the issue. Still, he cautioned against eliminating the legal minimum because it would give the post office "leeway to cut the prices" if it wanted to.

"It's a matter of what's the appropriate legal minimum, because if the post office crosses the line, the PRC could take action against them," he said.

More than attacking Amazon

The PRC is currently reviewing the current 5.5 percent requirement and is expected to finalize its decision later this year. In a note published Thursday, analysts at UBS said the PRC's review provides a "potential path to higher package prices," but forecast it would only drive a "modest increase."

It's still unclear why Trump singled out Amazon for causing the post office to lose money. Some say he may have gotten the idea from a widely read Citigroup report that said the post office is losing roughly $1.46 per package shipment.

But Jamison, the former postmaster, said Trump's claims are not true because the PRC is legally required to provide oversight over private deals, like the one it has with Amazon, and ensure they're profitable. In its annual report last week, the PRC said it has 846 private agreements and only 4 of those failed to meet the minimum cost allocation requirement (none of which were Amazon's).

If anything, Trump's attacks have caused even more confusion to an already complicated matter, Jamison said. Besides the cost structure, there are many factors to consider before making any pricing changes, like the fact that the post office runs both a monopoly and competitive business, and is often treated as public infrastructure with a universal service mandate.

"It's much broader than just attacking Amazon," he said.

WATCH: Trump says Amazon not on an even playing field