The Walt Disney Company reported fiscal third-quarter earnings and revenue that missed analysts' expectations on Tuesday.

Here's how the company did compared with what Wall Street expected:

- Earnings: $1.87 per share vs. $1.95 per share forecast by Thomson Reuters

- Revenue: $15.23 billion vs. $15.34 billion forecast by Thomson Reuters

In the year-ago quarter, Disney reported adjusted earnings of $1.58 per share on revenue of $14.24 billion.

Shares of Disney initially slipped 2 percent in after-hours trade. The stock was last seen edging slightly above its closing price.

Despite the top and bottom line miss, the entertainment giant saw strong growth in its studio, parks and broadcast units.

Disney said its studio revenue grew 20 percent year over year to $2.88 billion, driven by the strong box office performances of Marvel's "Avengers: Infinity War" and Pixar's "Incredibles 2."

Both movies quickly crossed the $1 billion mark in the global box office. "Avengers: Infinity War" — which had the biggest opening weekend of all time both domestically and overseas — crossed that milestone in just 11 days. That pace is faster than any other movie in history.

Here's what each business unit reported in revenue compared with what analysts expected, according to StreetAccount consensus estimates:

- Media and networks: $6.16 billion vs. $6.10 billion forecast by StreetAccount

- Parks and resorts: $5.19 billion vs. $5.28 billion forecast by StreetAccount

- Studio: $2.88 billion vs. $2.89 billion forecast by StreetAccount

- Consumer and interactive: $1.00 billion vs. $1.11 billion forecast by StreetAccount

While the parks business posted a 6 percent year-over-year increase in revenue, the segment saw operating income surge 15 percent year-over-year to $1.34 billion. Disney said the the surge in operating income was driven by higher guest spending amid higher average ticket prices and room rates as well as increases in food, beverage and merchandise spending.

Disney's broadcasting business saw a stunning 43 percent year-over-year growth in operating income to $361 million amid higher program sales, affiliate revenue growth and network advertising revenue. The company said higher sales of "Designated Survivor, "How to Get Away with Murder" and "Grey's Anatomy" helped drive that increase.

In April, Disney launched ESPN Plus, a sports-focused streaming service. While the service is still in its early days, CEO Bob Iger said in a Tuesday earnings call that the service is already seeing "strong" conversion rates from free trials to paid subscriptions. The longtime CEO said that the subscription growth is exceeding the company's expectations, but did not provide specific numbers for that metric.

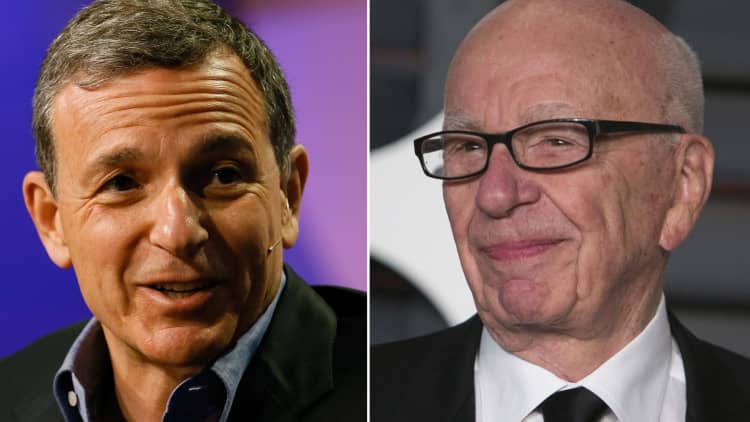

Disney's third-quarter earnings come as the entertainment giant is in the process of acquiring major parts of Twenty-First Century Fox.

In July, shareholders of both companies approved the $71.3 billion cash and stock deal to combine Disney with Fox's film and television studios. Disney will also take Fox's stakes in European pay TV operator Sky, India's Star and Hulu.

The deal was approved by U.S. antitrust regulators in late June, on the condition that Disney would sell Fox's regional sports networks. Disney still needs to clear regulatory hurdles overseas.

In buying Fox assets, Disney can grow its content library as it prepares to launch its own streaming service in 2019. CEO Bob Iger told CNBC in December that the purpose of the deal "is to create even more high quality content and then to distribute it in ways that consumers prefer and consumers demand in today's world."

To be sure, the content Disney already owns is doing well by many measures. The entertainment giant received 39 Emmy nominations this year.

Disney shares have gained 6 percent so far in 2018, hitting a 52-week high of $114.68 on July 19.

Fox is slated to report earnings after the market close on Wednesday.

Disclosure: Comcast is the owner of NBCUniversal, parent company of CNBC and CNBC.com. Comcast is also a co-owner of Hulu.