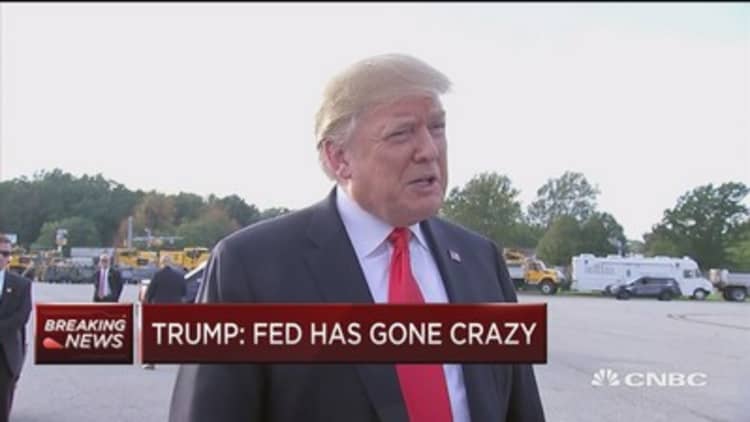

President Donald Trump knocked the Federal Reserve for continuing to raise interest rates despite some recent market turbulence.

"I think the Fed is making a mistake. They are so tight. I think the Fed has gone crazy," the president said after walking off Air Force One in Erie, Pennsylvania for a rally.

Fears about rapidly rising rates helped cause the Dow Jones Industrial Average to drop more than 800 points Wednesday. The S&P 500 posted its worst day since February and clinched its first five-day losing streak since 2016.

"Actually, it's a correction that we've been waiting for for a long time, but I really disagree with what the Fed is doing," the President added.

The Fed has raised interest rates three times this year and is largely expected to hike once more before year-end.

The most recent September rate hike drew criticism from Trump at the time, who said he was "worried about the fact that they seem to like raising interest rates, we can do other things with the money," he said.

Market expectations for a December rate hike were at 76.3 percent, according to the CME Group's FedWatch tool.

White House press secretary Sarah Sanders downplayed Wednesday's steep sell-off on Wall Street, noting the U.S. economy remains in good shape.

"The fundamentals and future of the U.S. economy remain incredibly strong," Sanders said in a statement. President Trump's economic policies are the reasons for these historic successes and they have created a solid base for continued growth."

Trump's comments on the central bank Wednesday came a day after he said he did not like what they were doing in terms of monetary policy. On Tuesday, Trump noted: "We don't have to go as fast." He also said he did not want the economy to slow "even a little bit" when there are no signs of inflation.

Criticism of the Fed is rare from a sitting president, with Trump's predecessors largely refraining from comment on the direction of the central bank's monetary policy.

Interest rates have been on the rise over the past several weeks, with the benchmark 10-year Treasury note — a barometer for corporate debt and mortgages rates — climbing to its highest level in more than seven years.

Following the central bank's move to hike rates a third time this year, Fed Chair Powell said in an interview with PBS that U.S. monetary policy is "far from neutral," suggesting front-end rates have further room to rise.

"Interest rates are still accommodative, but we're gradually moving to a place where they will be neutral," Powell said added. "We may go past neutral, but we're a long way from neutral at this point, probably."

Powell said at the Fed's latest press conference that he had not discussed interest rates with the president.

— CNBC's Fred Imbert contributed reporting.