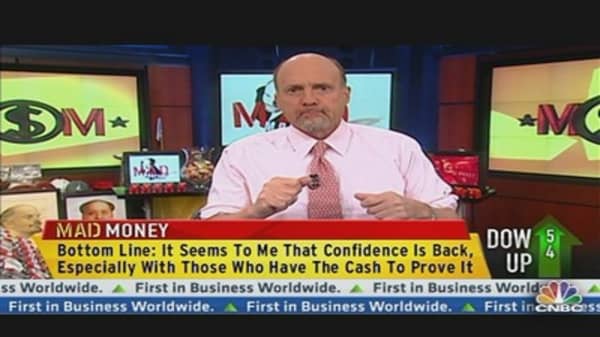

"People like to fight the tape, even on a terrific day like today," said Jim Cramer, host of CNBC's "Mad Money w/Jim Cramer." "It's a natural instinct given how mediocre stocks have been for so many years. The 'buy the dips sell the rips' attitude has been the way to win since 2000, but it isn't winning now."

After all, the Dow and the S&P 500 have both rallied 7 percent since the beginning of the year. The S&P has climbed for the past seven-straight weeks, though most of the gains have been small. Anyone who sold rips several months ago hasn't had a chance to buy dips because there hasn't been any, Cramer explained.

To Cramer, the market is likely to continue to rally so long as businesses have the "urge to merge." There have been a flurry of mergers and acquisitions in the past week or so, including a move by 3G and famed investor Warren Buffett's Berkshire Hathaway to buy H.J. Heinz for $23.3 billion. Meanwhile, OfficeMax and Office Depot are also in talks for a merger deal.

(Read More: We Know M&A's Back—But Where's It Going Next?)

"Confidence is back particularly among those who have the most dollars to back it up," Cramer said. "I know the first person to say R-I-P to sell the RIPS will be hit with a gigantic sell off right in his face. But let's tell the truth, waiting for a dip in the face of pool of liquidity … is like waiting for the Pacific to run dry."