The South By Southwest Interactive festival draws so many entrepreneurs, it naturally also draws venture capital investors hoping to find the next big thing.

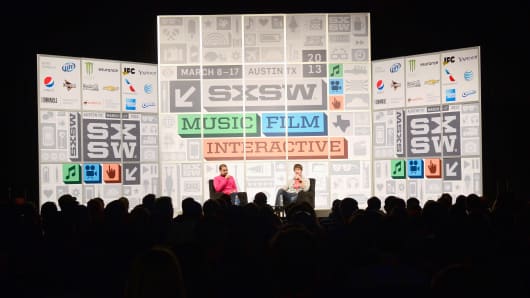

"This is such a nexus of energy and smart people and cool stuff," said Kleiner Perkins partner Bing Gordon, who co-founded Electronic Arts and sits on the board. "Anytime technology can hang out with entertainment it's always worth showing up. This is like the Coachella of tech."

Gordon said he's excited about the potential of "the maker movement"—new products that came about thanks to the growing availability of 3-D printers like MakerBot. He pointed to Ouya, a new video game console that gained traction on Kickstarter, Leap Motion and Memoto's life-blogging camera.

"Atoms are a good way to go," Gordon said of the rise of gadgets instead of prior years' obsession with apps.

(Read More: Gadgets Grab Buzz)