So what's the appeal for Icahn?

With a $6.7 billion dollar market cap, Nuance shares have declined over 20 percent in the past year, as its margins have declined on higher investments in R&D and marketing.

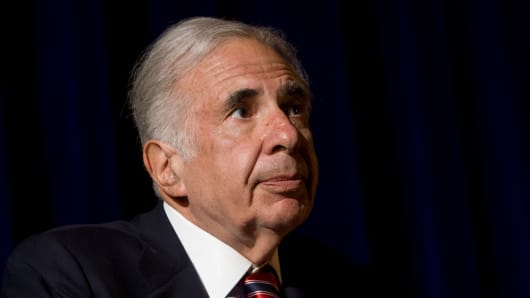

(Read More: Carl Icahn to CNBC: Why I'm Betting on Herbalife)

In addition to Siri, Nuance also makes Dragon speech-to-text software, which offers transcription tools for healthcare providers, businesses, and the likes of Microsoft windows. And this month the company even announced the integration of Dragon Voice into Panasonic Smart TVs.

The question now: What does Icahn have planned?

The investment is passive, for now, but investors are speculating about how quickly he could turn active.

(Read More: Icahn, Ackman in Epic Showdown of Billionaires)

Stifel issued an analyst note saying that with a debt-heavy balance sheet and a growth strategy that relies on M&A, it's no surprise that investors might be interested in looking at alternatives for the company.

Analyst Tom Roderick said he thinks Icahn is weighing four options: 1) lobbying for changes in corporate structure, like changes to executive compensation or a reduction in M&A activity, 2) waging a proxy battle for control of the board and the management team, 3) pushing to maximize value by divesting business segments, and 4) evaluating the potential for an outright sale of the company, which Roderick ssaid is less likely given the how disparate the business lines are.

—By CNBC's Julia Boorstin; Follow her on Twitter: @JBoorstin