Federal Reserve Chairman Ben Bernanke would not risk a premature withdrawl of the stimlus that has underpinned the U.S. economic recovery, former vice chairman of the Fed Alan Binder told CNBC.

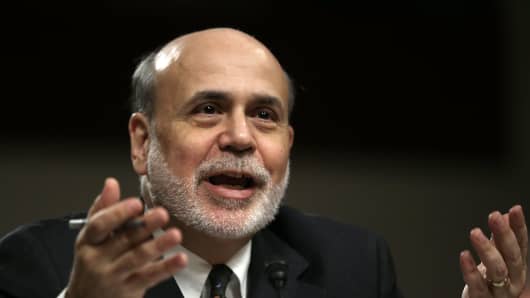

In a testimony to Congress on Wednesday, Bernanke sounded a dovish tone, remarking that the premature tightening of monetary policy carries a "substantial risk" of slowing the economic recovery. But in an answer to a question from a congressional committee, he also said the central bank could start paring back purchases in a couple of months and these comments helped send U.S. stocks lower.

(Read More: Aiming for Nuance, Bernanke Does Rhetorical Figure Eights)

"All you hear about is what if the Fed overstays its hand and we get inflation. They could make an error like that, but they could also make an error of withdrawing the accommodation too soon - and he [Bernanke] made that point very strongly today," Blinder told CNBC late Wednesday in New York.

Hawkish members of the central bank have been vocal about their belief that quantitative easing should be wound down sooner rather than later.