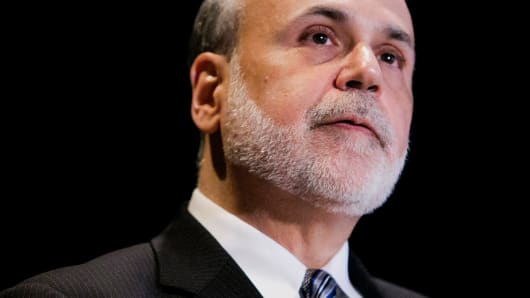

Fed Chairman Ben Bernanke is not likely to say much new when he testifies before Congress Wednesday, but even so, he could rock the markets.

"His prepared remarks are going to be pretty much in line. He's not breaking news," said Daniel Greenhaus, chief global strategist with BTIG. Fed Chairman Ben Bernanke will give his semi-annual testimony on the economy before the House Financial Services Committee. He appears at 10 a.m. ET to deliver his comments and take questions, but his prepared remarks will be released at 8:30 a.m. ET.

(Read More: Enjoy it while it lasts: Bank earnings face trouble)

Besides Bernanke's testimony, the Delivering Alpha conference, produced by CNBC and Institutional Investor, takes place in Manhattan. Treasury Secretary Jack Lew speaks, just before 8:30 a.m., and major investors, like Carl Icahn, Nelson Peltz and John Paulson will also be there. Preet Bhrarar, U.S. Attorney for the Southern District of New York, is also a featured speaker.

There are also dozens of early earnings, including Bank of America, Bank of NY Mellon, PNC Financial, Northern Trust, St. Jude Medical, Textron, Mattel and Novartis. After the bell earnings include American Express, Intel, eBay, Noble Energy, Kinder Morgan, El Paso Pipeline, and Sallie Mae.

Wednesday's economic reports include housing starts and building permits, at 8:30 a.m. ET, and the Fed's beige book on the economy is released at 2 p.m.