(Click for video linked to a searchable transcript of this Mad Money segment)

If you've got the time – Cramer's got the trade. (That's an homage to a popular beer campaign launched in the 1970's - scroll to the bottom to find out which one)

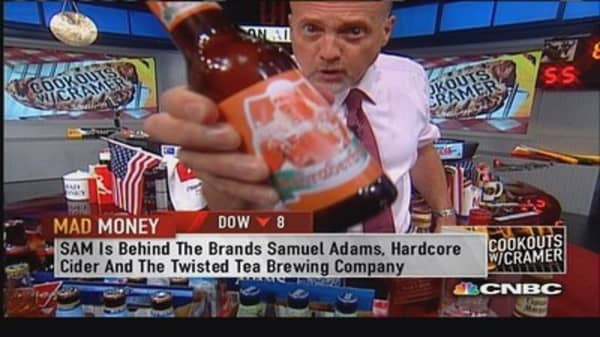

"It's looking like we've got a burgeoning, red hot bull market in the beer stocks," mused Cramer.

According to Nielsen, for the four weeks ending on August 3rd, beer sales in the U.S. were up 3.8%, a noteworthy increase from the 1.8% increase in the previous four weeks.

The Mad Money host always does his homework, and he's found a second 'tell' to support the thesis - he believes results from Boston Beer confirm demand has increased for beer.

"Craft beers like Sam Adams have been sweeping the country, and you can see that in Boston Beer's earnings report," Cramer explained. The company delivered $1.45 of earnings per share, an 11-cent beat, it's revenues came in higher than expected, rising 22.9% year over year, shipments were up 22%, and the company gave upside guidance for the full year. In response, Boston Beer shot up from $178 to $204, a 14.6% move in a single day's trading. "

Although Boston Beer may provide a valuable 'tell' Cramer does not think the way to harness the trend is with Boston Beer stock.