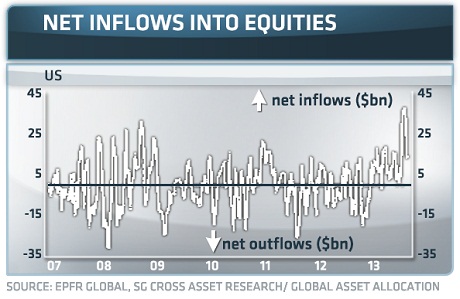

Societe Generale joined a growing chorus of banks growing increasingly bullish on European equities at the expense of U.S., Japanese and emerging market stocks, and forecast a net $100 billion could soon flow back into the struggling continent.

A sharp rebound in European stocks has accompanied better-than-expected business data over the last few weeks, despite market fears the U.S. Federal Reserve may soon taper off its asset-purchasing program as soon as September.

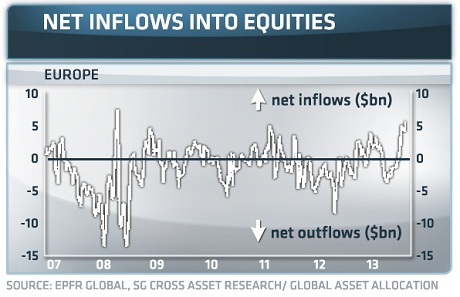

And there's much more upturn in Europe to come, according to the asset allocation team at SocGen, which measured flows into mutual and exchange-traded funds.

"European equities should enjoy net inflows of $100 billion soon," SocGen said in a research note Thursday.

(Read more: Why it's still 'too early' to dive into European stocks)

"We firmly believe that Fed tapering will favor European assets relative to U.S. assets. Although the flows have been particularly thin this summer, the latest data confirm that net inflows are picking up for European equities, whereas they are slowing for U.S. equities," the note said.

Philippe Ferreira, a global strategist at SocGen, said that recent GDP numbers and Thursday's better-than-expected business data had confirmed his bullish view on Europe.

"The recovery in the region is not priced in," Ferreira told CNBC, saying that "green shoots" were evident from recent data. European equities are undervalued, he added, and Fed tapering will negatively affect emerging markets and U.S. stocks that have rallied, but will leave European equities relatively untouched.

(Read more: European equities looking cheap as recession eases)

European stocks have already experienced a modest rally this year. The U.K.'s FTSE 100 is up 8.36 percent, the German DAX is up 8.84 percent, and the pan-European Euro Stoxx 50 is higher by 5.26 percent.

The S&P 500, meanwhile, has logged gains of 15 percent, while the Japanese Nikkei is up 29 percent.

SocGen's forecast echoes recent calls by strategists at Nomura, Bank of America Merrill Lynch and JPMorgan, who all predict an upside for Europe as it battles its way out of a sovereign debt crisis. According to the OECD (Organization for Economic Co-Operation and Development), the euro zone economy grew by 0.3 percent in the second quarter from the first, its first GDP expansion since third-quarter 2011.

(Read more: Global economic uptick boosts stocks, euro)

"If you look at our portfolio, we're most overweight Europe, and within that, European financials," David Herro, manager of the $21 billion Oakmark International Fund, told CNBC Wednesday.

The EURO STOXX Banks index stood at 181 points on Thursday, having peaked at 490 points in May 2007 and troughed in July 2012 at 75 points.

"The European recovery has legs and this is the best way to play it," added Herro.

(Read more: 'Fund manager of decade': Buy European banks)

Christian Gattiker, head of research at Julius Bar, also favored European stocks, citing better growth, lower sovereign bond spreads and improved crisis management. He told CNBC the rally could see the Eurostoxx 50 gain 20 percent to 30 percent.

Steen Jakobsen, the chief economist at Saxo Bank, forecast that Germany's DAX could easily rise 10 percent but said the "free ride" would not last beyond the next quarter.

"2014 is going to be a horrible year. That is going to be the wake-up call," he told CNBC on Wednesday.

A normalization of interest rates and the U.S.'s struggling health-care reforms were two reasons Jakobsen forecast difficulties next year.

"All the cyclicality comes to roost in 2014," he said.

By CNBC.com's Matt Clinch. Follow him on Twitter @mattclinch81