Ask a financial planner where the market is going and he or she is likely to ask who wants to know.

Tell them you're worried about a bubble in U.S. stocks and what it could do to your portfolio and they'll ask you why you're worried and when you might need to start drawing money from the account.

Basically, financial planners don't like investment conversations absent the context of a specific client's financial situation.

"We're all about looking at investments in the context of a broader picture," said Janet Stanzak, who runs the advisory firm Financial Empowerment LLC and is serving as the 2014 president of the Financial Planning Association. The FPA is a 23,000-member national organization for certified financial planning professionals.

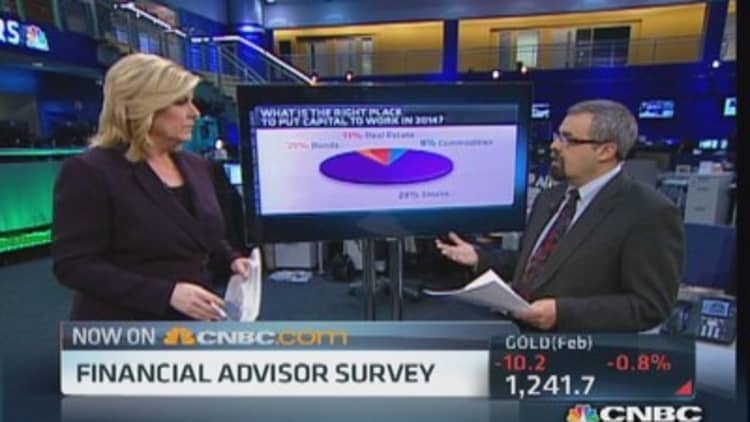

A CNBC/FPA survey of 1,449 of those members showed that certified financial planners are still bullish on stocks. To that point, 87 percent of respondents said stocks were the top choice for "where to put capital to work in 2014."

Real estate was ranked second highest, with 5.3 percent of the planners surveyed, followed by commodities (4.6 percent) and bonds (3.1 percent).

(Read more: Recovering economy may rein in bull market)

The survey's executive summary suggested that the lack of apparent interest in commodities illustrated that planners expected "inflation to remain low in the coming year."

Meanwhile, the survey summary attributed the low showing for bonds to a "wide agreement among advisors that interest-rate risk is exceptionally high right now."

The main reason to buy stocks is that they have a fantastic record over time, beating inflation and providing a good return.Daniel Moisandprincipal at Moisand Fitzgerald Tamayo

The results, however, don't suggest that advisors are bailing out on bond allocations and buying more stocks for their clients.

"Bonds can be a stable reserve of value, or they can be as volatile as stock," said David Yeske, co-founder of advisory firm Yeske Buie Inc. "I think a lot of advisors are shifting their bond allocations to shorter maturities and higher credit quality."

Yeske, who participated in the survey, said that 100 percent of his fixed-income portfolio currently has a duration of less than a year and an average credit rating of single A.

The overwhelming attraction to stocks doesn't surprise Daniel Moisand, a principal with Moisand Fitzgerald Tamayo, who participated in the survey.

"The main reason to buy stocks is that they have a fantastic record over time, beating inflation and providing a good return," he said. "People need stocks in their portfolios for growth."

(Read more: Soaring stocks, D.C. gridlock worry wonks)

Vicki Fillet, an advisor with Blueprint Financial LLC, suggested that the survey reflected the general enthusiasm for stocks among the investing public.

"It's human nature. Equities are up, so you want to be in stocks," Fillet said.

She was, however, quick to put that in context.

"As planners, we take care of our clients' needs," she said. "We can increase risk levels, but not to a degree that gets clients into trouble."

Financial planners think the need for growth is just as important for retirees as younger investors, with 76 percent of respondents recommending that an allocation of between 51 percent and 75 percent of a retiree's portfolio be in stocks.

"People need stocks for growth, regardless of how old they are," Stanzak said. "Retirees can still have 30 to 40 years where they need to meet their financial needs."

After a year that saw the S&P 500 Index advance by more than 30 percent, survey respondents also showed strong interest in investing more outside the U.S.

Eighty-one percent said they planned to discuss increasing exposure to international markets with their clients. They showed a slight preference for emerging markets (51 percent) over Europe (49 percent).

"Notwithstanding the boom and bust cycles in emerging markets, there's every reason to believe that they'll continue to be among the fastest-growing markets in the world," Yeske said. "There's a wide range of advisors and financial planners who see the virtue of building global portfolios."

When asked if they saw a benefit to increasing tactical allocations in a variety of asset classes, survey respondents continued to show a preference for equities over other investments.

International developed countries' stocks were selected by 45 percent of those surveyed, while emerging markets got the nod from 43 percent of planners surveyed.

Large-cap stocks were selected by 39 percent of those surveyed, followed by mid-cap stocks (33 percent) and small-cap stocks (31 percent). Commodities (16%) and fixed income (12%) were ranked lowest.

(Read more: Investor guide to getting out of an annuity)

Worth noting is that 30 percent of those planners surveyed said they had no tactical weighting at this time.

"Questions about tactical asset allocation are a good way to start a fight in a room full of financial planners," Moisand said. "You won't find a lot of planners who will move large percentages of their clients' assets into one asset class or another."

Indeed, the general consensus among certified financial planners surveyed appears to be that a disciplined commitment to rebalancing their client portfolios back to target allocations is about as tactical as they want to get.

That would necessarily mean shifting funds away from hot markets such as U.S. stocks and into poorly performing sectors such as emerging markets.

(Read more: Alternatives growing on investors)

Yeske, for one, has been selling large-cap and small-cap U.S. stocks and buying global real estate, emerging-market stocks and even bonds over the last six months.

He said that many of his clients are still traumatized by the financial crisis of 2008 and want to get out of the U.S. market after the recent run-up.

"I agree, but we do it according to plan," he said. "It's all about rebalancing."

—By Andrew Osterland, Special to CNBC.com