When a pack of wine collectors arrived in the private second floor of Manhattan's Bowery Hotel last Thursday for an auction held by Acker Merrall & Condit, they weren't there to hold back. Before guests started waving white paddles to bid on 730 lots of wine—several of which went for tens of thousands of dollars and set world records—fellow collectors chatted over a tasting table.

It was an enthusiast's dream. The spread included a slew of wines from every major region: Among them, a 1937 red Burgundy and an ice bucket loaded with three magnums (1.5 liters each) of Krug champagne. To a casual observer, the scene shouted "bull market."

And yet, the strength of the auction might have come as a surprise to anyone who follows major wine indexes such as the Liv-ex Fine Wine 100 and the Wine Spectator Auction Index. Those widely watched indexes gained momentum after the financial crisis, but peaked in 2011 and have been in decline since. The Liv-ex Fine Wine 100 index, which is considered a broad benchmark, is down a full 33 percent from its peak.

What happened? Wine experts, including Acker Merrall CEO John Kapon, say that key is the rise and fall of wines from France's Bordeaux region. Those wines, which include fabled producers such as Lafite Rothschild and Haut Brion, are wildly popular with buyers from China, where such wines often serve as high-status gifts. But in the last few years, prices of some expensive Bordeaux wines have fallen significantly, bringing the indexes down with them.

Indeed, 84 of the wines in the Liv-ex Fine Wine 100 are from Bordeaux, according to the most recent data on the company's website. Liv-ex calls the Fine Wine 100 index "the industry leading benchmark." To adjust for the shift in the market, Liv-ex has lowered its Bordeaux weighting downward to the current level from approximately 95 percent Bordeaux in 2011.

But for auctioneers such as Acker Merrall, Bordeaux has become even less important. So far this year, Bordeaux wines have accounted for about 30 percent of sales at his auctions, down from 40 percent in 2013 and 50 percent in 2012, Kapon said.

Acker Merrall, which has been the single largest auctioneer by global sales of fine and rare wines over the last 10 years, has seen sales of wine in most regions outside of Bordeaux grind higher. Even without as much Bordeaux, which tends to be very expensive, Acker Merrall has held its own: The auctioneer earned $32 million in revenue in the six months through June, down slightly from $33.5 million in the same period of 2013.

What's picked up the slack? Kapon said the biggest help has probably been strength in wines from France's Burgundy region. Red and white wine from Burgundy have accounted for 47 percent of Acker Merrall auction sales so far this year. "It's basically replaced Bordeaux," he said.

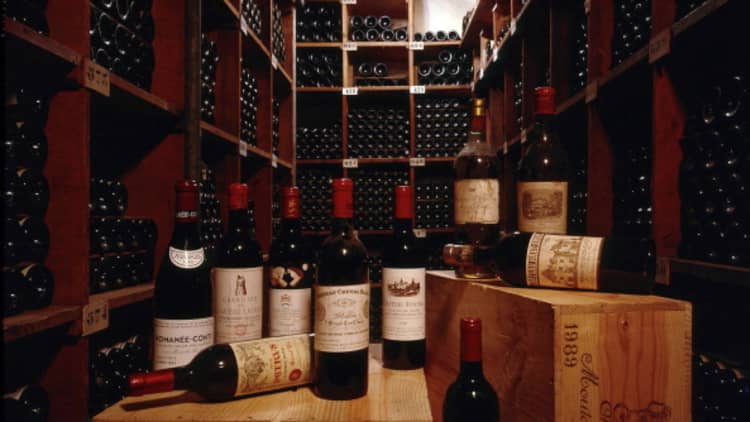

Strength in Burgundy was obvious at last week's auction. Among the world records set: A single bottle of 2005 Coche Dury Meursault Les Rougeots for $679.25; a magnum bottle of Domaine de la Romanée-Conti La Tache for $9,880; and a single bottle of Henri Jayer Echezeaux for $4,013.75.

One reason Burgundy has held up well is because there's simply less of it to go around. "The key is production size," said Patrick Stella, a collector at last week's auction. "Bordeaux has big production and the prices went crazy. That's not sustainable if demand pulls back," he said. "But Burgundy has guys waiting to get what little they can."

Read More$45 million for a viola? It's a Strad, but...

Indeed, even at a large auction such as Acker Merrall's, it is unusual to see a full case of rare Burgundy. Instead, there were often bundles of three bottles from different cases or even individual bottles. Romanée-Conti may only produce a few hundred cases per year, while some of the most highly regarded Bordeaux chateaux produce several thousand per year.

Wine collectors say that Bordeaux producers may have tried to control supply as the market ran up a few years ago to drives prices even higher. But that may have prompted collectors to look elsewhere as prices reached stratospheric levels. "If the [Bordeaux] producers aren't careful they'll lose a generation of wine drinkers," Kapon said.

Still, many older Bordeaux wines remain rare enough that prices have held up fine. The 1982 vintage of Mouton Rothschild, for instance, sold well above the minimum estimated price of about $1,000 a bottle in several lots at last week's auction. "The older ones are better investments because they are scarcer," Kapon said. "People are also going for these older wines because you can drink them right now."

The same is probably true of older Champagne, which also tends to get consumed rather quickly. A magnum of 1989 Roederer Cristal Rose set a record at $2,346.50 last week.

Who is keeping the market firm? Stephen Bilkis, a collector who has attended auctions for 20 years, picked up several bottles at last week's auction. His haul included one of Burgundy's most famous: A bottle of 2008 Romanée-Conti that set him back about $11,000. Bilkis also grabbed his favorite, a 1997 magnum of California's Screaming Eagle, which cost a cool $10,500.

Bilkis acknowledges that he doesn't drink such pricey wines often and that a real sign of strength in the market may be at more affordable price points. "While China's cooled off and you don't have billionaires supporting the market, you have people who can afford to drink a $100 bottle," he said. "The market has recovered, your cash is safe, you're pension's ok, so why not?"

—By CNBC's John Jannarone