Bears and doves are out and the bulls and hawks are in.

The CNBC Fed Survey for September, conducted from Thursday through Saturday, ahead of a potentially contentious Fed meeting this week, finds the Street more optimistic on both economic growth and stocks and moving up its timetable for an interest rate hike.

Respondents now see the Fed starting a rate-hike policy in June 2015, up a month from the previous survey and the second survey in a row that has seen more rapid rate-hike expectations. The average funds rate for both 2015 and 2016 is now somewhat higher, and respondents expect the Fed to finish the tightening cycle in the third quarter of 2017 at 3.2 percent, a quarter earlier than the last survey.

Read MoreWall Street expects really dovish Fed on rate hikes: Survey

"The Fed in the months ahead will begin to say a long goodbye to its extraordinary monetary accommodation, keeping its exit more a process than an event, hoping throughout to keep markets and the economy stable,'' Pimco's Tony Crescenzi wrote in response to the survey.

More than 40 percent of the 37 respondents, who include economists, fund managers and strategists, see the Fed at this week's meeting dropping the reference to "considerable time" for not raising rates. The language referred to the time the Fed would wait from when it stopped buying bonds to when it would first increase rates. But 24 percent don't see the phrase being dropped until October and another 24 percent see it occurring as late as December.

Read MoreMarket reaction toFed hinges on these two words

"The press have done the Fed's job of preparing the markets for a change in policy so the FOMC should take advantage of the opening by signaling a tightening could come sooner rather than later,'' said Joel Naroff of Naroff Economic Advisors.

The outlook for a somewhat more hawkish Fed comes with a more upbeat view on the economy. In the first meaningful upgrade to the economy in nine months, Fed survey respondents now see year over year growth in the U.S. at 2.3 percent in 2014, up from 1.9 percent in the last survey, and 2.9 percent in 2015, up from 2.75 percent. The chance of recession in the next 12 months remains a slim 15 percent, the second lowest in the history of the survey. The inflation outlook is stable at 2 percent for this year and 2.27 percent for 2015.

"The U.S. economy finally has 'normalized,' said Allen Sinai of Decision Economics. "In a 'normal' business expansion, interest rates should rise. Zero interest rates make little sense in a normal business expansion."

Read MoreWall Street view on Fed rate hikes changing

Not much in the troubling global headlines really bothers Wall Street. Asked about the risk of ISIS, Scottish independence, the Ukraine conflict and European economic weakness, respondents rate only one measure above 5, with European economic weakness rating a 5.4. The chance of Scottish independence creating greater global risk was rated just a 3.1.

Respondents have grown considerably more bullish on stocks and mellow on bonds. Survey respondents see about 2.5 percent upside for the through the end of the year and 8.4 percent by the end of 2015, or 2.5 percentage points more than they were estimating in the previous survey. That's bullish both because it's higher than prior estimates and because, as a group, survey respondents have underestimated the stock market for several years.

As for bonds, respondents lowered their outlook for the 10-year yield to 2.76 percent by year end and 3.45 percent by the end of 2015, both mostly unchanged from the previous survey.

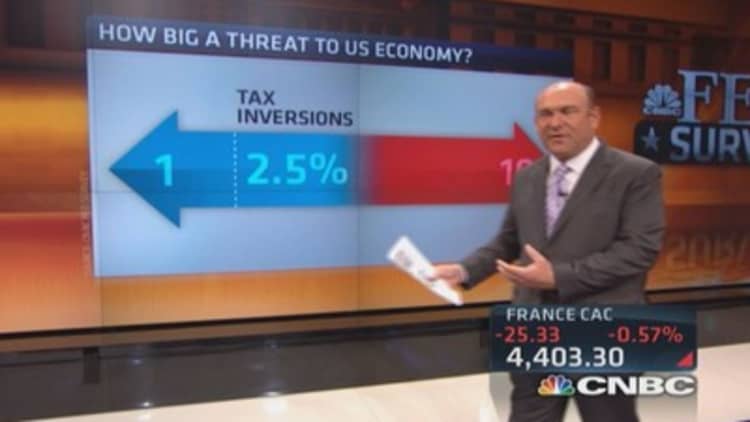

On a separate issue, the survey finds that Wall Street believes the best way to solve the tax inversion problem is to reform the entire corporate tax system, not with a quick fix for just inversions. Half of respondents say comprehensive reform is the best fix, with 38 percent choosing "lower the corporate tax rate now." Among those who want the rate lowered, they favor a maximum rate of just 18 percent. Only 3 percent support one of the likely outcomes to be chosen by the Treasury Department: raising the requirement for foreign ownership.

Read MorePimco's McCulley: Yellen facing big challenge

Six percent had other suggestions, such tax amnesty and stopping the practice in the U.S. of taxing global corporate earnings, rather than just domestic profits.

—By CNBC's Steve Liesman

CORRECTION: This version corrected the spelling of Crescenzi.