Saudi Arabia's outspoken member of the royal family, Prince Alwaleed Bin Talal, has called on authorities to create a sovereign wealth fund to help reduce the state's reliance on oil.

"What I'm asking for now in this open forum is to have an active sovereign wealth fund, and to put in it all the excess foreign exchange that you have, all the money you have…" Prince Alwaleed told reporters in the Saudi port city of Jeddah while visiting the construction site of Kingdom Tower.

Read MoreSaudi Prince's libel fight costs $2.2 million, so far

The OPEC kingpin does not have a sovereign wealth fund in the form of many of its oil-rich counterparts in the Gulf. Surplus earnings are invested by SAMA Foreign Holdings, an entity controlled by the country's central bank, the Saudi Arabian Monetary Agency.

Assets were valued at $757 billion as of October 2014, according to the SWF Institute, and investments are understood to be in mostly conservative asset classes such as bank deposits and US Treasury bonds.

"The Norway fund is our role model because they have around over $850 billion sovereign fund and they make out of this around $40 billion to $50 billion. And that amount covers almost all the requirements of the budget in Norway," he was quoted as saying by local media.

Very little is known about the international portfolio of SAMA Foreign Holdings, one of the region's most secretive investment funds. It stands in stark contrast to its peers in the region, from Qatar to the United Arab Emirates, who have embarked on a highly-visible spending spree around the world.

In neighboring Bahrain, the Mumtalakat Holdings sovereign wealth fund, a shareholder in U.K. automaker McLaren, spoke to CNBC in an exclusive interview over the summer about its global investment strategy.

Bahrain fund open to McLaren stake sale

A SWF proposal has in fact already been discussed by the kingdom's legislators this year, albeit no decision has been taken.

"Clearly the income from our sovereign wealth fund would not cover all our budget, but at least should cover a good size of it," Prince Alwaleed added.

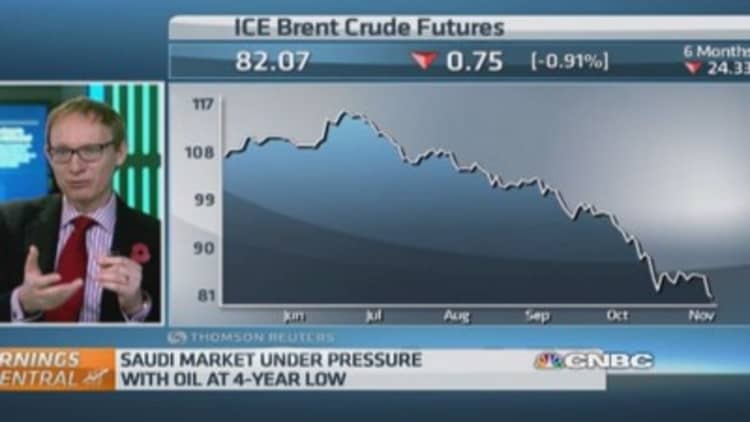

The comments come on the heels of an open letter he sent to the Saudi government last month, criticizing what he saw as a complacent reaction to falling oil prices. At the time Brent crude was trading just below $90 a barrel.