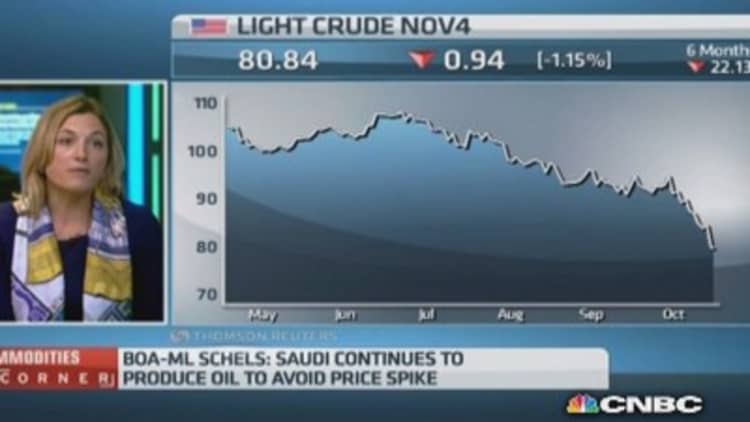

As amid plentiful supply and faltering demand, crude exporters from OPEC—and most importantly, Saudi Arabia—have little room to maneuver and may put up with lower oil prices for now.

The from the International Energy Agency (IEA), published on Tuesday, showed that rather than cut production, Saudi Arabia increased its oil output by 50,000 barrels per day (bpd) in September to 9.73 million.

"Riyadh appeared determined to defend its market share in the increasingly competitive Asian market—cutting its formula prices for a fourth consecutive month," the report speculated.

But for now, Saudi Arabia has indicated it may be willing to accept a period of lower prices. Not that everyone in the country is happy about that. Saudi billionaire investor Prince Alwaleed Bin Talal on his website this week lamented the Kingdom's complacency in an open letter to the country's powerful oil minister, Ali Al-Naimi. He condemned "statements designed to minimize or underestimate the negative effects" of a slide in oil prices, pointing to the precarious over-dependence of the state budget on petrodollars.

Read MoreDespite washout, hedge funds holding onto energy

Apart from anemic growth in the global economy, other powerful shifts within the industry are giving the Kingdom incentives to tolerate lower prices—especially the threat posed by the burgeoning U.S. shale oil business.

"Saudi Arabia is attempting to develop a long-term outlook in response to this new reality of plenty," Jonathan Pierce, assistant professor at the Institute of Public Service at Seattle University argued. "They are following the trend in production, and recognizing that due to hydraulic fracturing (fracking) along with directional drilling, oil is no longer monopolized by OPEC."

Saudi advantage vs. shale producers

Lower crude prices are tougher for shale oil producers to handle than they are for the Saudis, because of the higher costs associated with shale. The Saudis have enough money on hand to be able to navigate a period of low prices, if that's what it takes to keep ambitious competition in check.

"Saudi Arabia has generated cumulative budget and current account surpluses of $600 billion and $1 trillion, allowing it to build up (foreign exchange) reserves equivalent to some 90 percent of GDP (three full years of public spending) and pay down debt from 100 percent of GDP to less than 5 percent of GDP," HSBC Global Research said.

Meanwhile, Iran's deputy oil minister, Rokneddin Javad, was quoted by state news agency Shana as saying the drop in prices would be "short-lived" and would not affect his nation's budget.

OPEC members are due to convene on Nov. 27 in Vienna to formulate policies for 2015—and possibly demonstrate to the world how they plan to remain a potent force in today's oil market.

"The ability of OPEC to impose joint production cuts historically has depended on the global business cycle," Lutz Kilian, professor of economics at the University of Michigan, explained to CNBC.

Against a weakening global economic backdrop, however, OPEC's options may be limited. Members have less of an incentive to stick to their quotas. "In the past," he said, "economics has proved more important than politics."