Enough is enough, already! Jim Cramer is sick and tired of the same companies whining, over and over again. Apple and Yahoo certainly weren't whining on Tuesday, especially Apple when it crushed earnings estimates to smithereens.

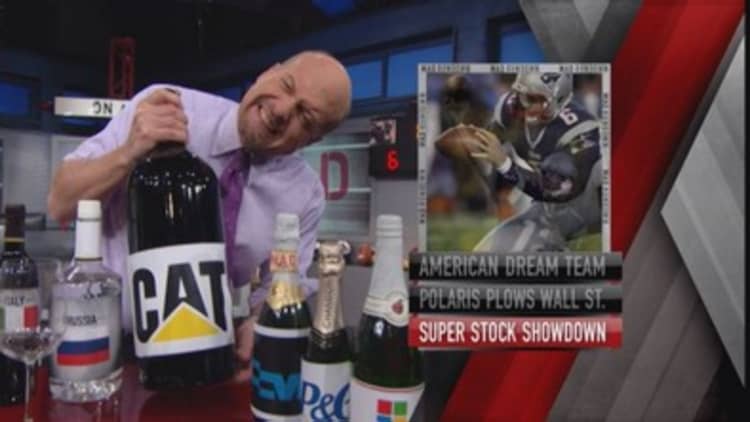

Perhaps it is time for these companies to drink a glass of wine and calm down, instead of whining about how the strong dollar is killing earnings and letting the complaints take down the market.

The "Mad Money" host did not care for the amount of howling on Tuesday, especially from Microsoft. It whined all over the place about currencies and bad execution in Japan and China.

And it could not get any worse for Freeport-McMoRan, thus Cramer warned to not even touch that stock with a 10-foot pole.

"But the biggest whiner of them all? Caterpillar. Holy cow, I have never seen anyone campaign as aggressively as CEO Doug Oberhelm to get on the 'Mad Money' wall of shame. That man is on a mission," the "Mad Money" host added.

Caterpillar complained about soft markets overseas, and how the weak oil and gas industry was the catalyst for the downturn of Caterpillar's big machines.

Can someone please hand Caterpillar a little violin?

Cramer understands that the power of the strong dollar can cause problems for CEOs. However, the whining is just too much. He provided his take on how to avoid boo-hoo crying companies in the future.

The "Mad Money" host recommended to invest in companies that don't whine before it's time. Meaning, if the CEO is complaining ahead of earnings to excuse their bad performance, that should be a red flag.

Secondly, Cramer thinks if you can't beat them, join them! If a company like Procter & Gamble gets it from currencies, what company benefits when P&G takes a hit? Unilever. So gobble up some Unilever while it benefits from the situation.

Then there is the easier approach of just seeking out the companies that didn't blow it and don't complain about how strong the dollar is because they have gotten just so darned strong they weren't affected. That would be companies like 3M, Honeywell and United Technologies.

"If you took the time to listen to the incredibly good conference call, you would've heard that they weren't really focused on the dollar, but on winning new business from other companies, taking share and taking names and taking no prisoners," Cramer said.

Lastly, who even needs to deal with overseas? Domestic companies don't need to worry about the impact of the dollar. Cramer recommended taking a look at some of the restaurant and retail chain stocks that were beat down on Tuesday, or even airline stocks like Southwest.

----------------------------------------------------------

Read more from Mad Money with Jim Cramer

Cramer Remix: Get a piece of this

Cramer: 8 healthy market signs

Cramer is craving Shake Shack's IPO

----------------------------------------------------------

"Throw out the strong-dollar whiners. They aren't worth drinking. Either stick with the domestic plays, or go with those companies that are doing so well that you don't even notice these currency fluctuations," said Cramer.

Wouldn't it make sense to just skip the drama, and go for the winners? Drink the wine instead, and don't listen to whining.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com