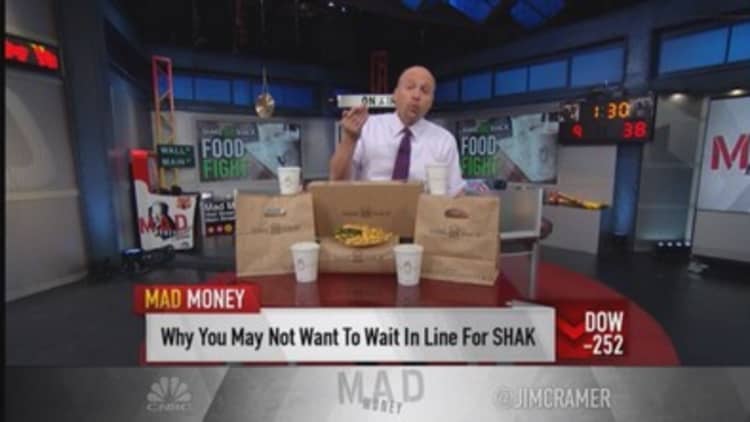

After the juicy burger chain Shake Shack initially priced at $21 and spiked up at the open to a monstrous $47 a share on Friday—Jim Cramer felt excitement on the burger news, with a side of frustration.

And it's not that the business isn't good, especially considering the fact that this company started as a food cart in Manhattan's Madison Square Park. Cramer was initially excited for the Shack, as investors weren't just investing in hamburgers. They had a chance to invest in the brilliant restaurateur, Danny Meyer.

The "Mad Money" host has known Danny Meyer for quite a long time, and he has no doubt that both Meyer and CEO Randy Garutti will do a great job with Shake Shack. Cramer's been known to bite into a ShackBurger on occasion as well.

Meyer's savvy business sense is evidenced in the "Danny Meyer hospitality index," an index he created to highlight companies with a powerful understanding of the hospitality quotient. It has now rallied 433 percent since its inception in February 2009, smashing the performance of the .

"As much faith as I have in Danny and his amazing team, I do not have the same amount of faith in the initial public offering process," said Cramer.

The "Mad Money" host has unfortunately seen over and over again that there is a complete inability to properly price merchandise of a popular service or device. In Cramer's perspective, no matter how awesome a company might be, the first few opening days may not be the best time to buy the stock.

The reason? There are two different kinds of shareholders for a hot stock like Shake Shack.

First, there are the investors who love the company and are devoted for the long term. They aren't sellers, they're owners.

Second, there are the flippers. Those are the investors who got the shares on a deal simply because they do a ton of business with the brokers who arranged the deal.

To understand the nature of a flipper, one must understand the nature of how IPO shares are distributed. Typically, brokers have dedicated clients who sincerely want to invest in the IPO and indicate interest in receiving shares. They also have clients that are flippers, and we are not referring to burgers.

These are investors who simply take IPO shares, and sell them as soon as it prices. Sometimes it works in their favor and make a big profit, and sometimes it doesn't. They don't hold positions for the long-term.

Cramer thinks that is probably how the Shake Shack deal went. The hitters get a bunch of shares, and some of it might have gone to clients that aren't flippers, but most likely a ton of shares went to the firms looking to make a few bucks and will look the other way as the shares are sold.

"They are the enemies of those who like the Shake Shack so much they bought a piece of it," Cramer said.

And maybe it is entirely possible that the syndicate desks at these first did their best to give shares only to those clients who won't sell. Either way, Cramer thinks this whole process is unfair, and unfortunately Meyer and his team are helpless to change it.

"But keep in mind that SHAK is now trading at $28 million a store, which if similarly applied to the admittedly vastly inferior McDonald's would put a trillion-dollar price tag on a $90 million company."

----------------------------------------------------------

Read more from Mad Money with Jim Cramer

Cramer Remix: Don't bet against this

Cramer: Zuckerberg is 'King Midas in a hoodie'

Cramer: One man's $90B impact on MCD

----------------------------------------------------------

So now Shake Shack's stock has become expensive, and it's under the microscope to grow into its market cap quickly.

Cramer's advice—let the flippers weed out of the stock, so it can stabilize. As long as you understand what is happening, it can be held and should be done so for the long term.

"If you don't, then I think you could be shaken out by the Shack on the first bout of bad news that has happened to the best of 'em."

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com