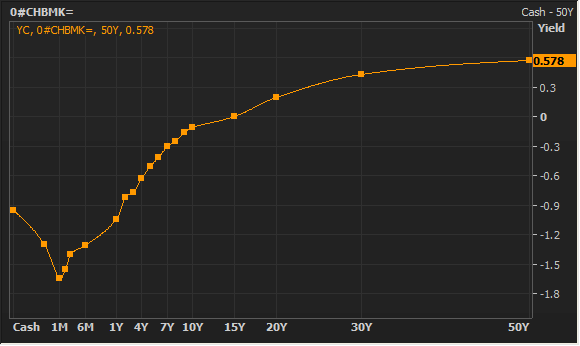

We are seeing "perverted yield curves" almost everywhere you look, though not to the same extent as in Switzerland.

Yield curves, which measure the spread between short- and long-term interest rates in a particular country, are typically positive, or upwardly sloping, during an economic expansion. They flatten during a slowdown, and invert before a recession, meaning that long-term rates are lower than short-term rates. That, historically, occurs when a central bank is raising short-term rates to cool an overheating economy. As short rates go up, investors buy longer-dated maturities whose prices will go up, and yields will fall, as higher short rates induce an inflation-killing recession.

Read MoreNegative yield bonds: Here's who's buying

In my experience, a flat, or inverted, yield curve is almost — and I stress almost — a sure sign that a slowdown, or recession, is on the horizon 6-to-9 months down the road, if not sooner.

Yield curves around the world have flattened considerably and, as I have suggested, inverted in a handful of countries. But rather than occurring as a result of central bank tightening, they are occurring as central banks lower short-term interest rates — a curious development, indeed.

These perverted yield curves are still indicative of slowdown, or recession, but they are being caused by deflation, rather than inflation. And thus a new bond market conundrum is born.

Read MoreThe case for buying negative yield bonds

We are not, by any means, in a typical business cycle anywhere in the world. In Denmark, for instance, MORTGAGE RATES are approaching zero! A home buyer is being paid to buy a home!

As Hamlet once said, "'tis a consummation devoutly to be wished!"

No matter where you look — in China, Japan, Europe, Latin America and, quite possibly the U.S., a slowdown appears imminent. The U.S. economy, growing more rapidly than the rest of the world, has already been affected by the overseas recession. Fourth-quarter growth was a full percentage point weaker, thanks to weakening exports. The U.S. is still growing and does not appear in danger of falling into recession. But clearly, the Federal Reserve, by its own admission, will watch the rest of the world to assess how much of an adverse impact it's having on the U.S.

Read MoreWhy some investors don't mind losing money

If we see more "perverted yield curves" elsewhere in the world, expect the Fed to divert from its planned course of action and defer any rate hikes until the perversion passes.