A strong dollar and low inflation still have the market believing the Fed will hike rates this year, but by less than previously expected, and with a later start.

The April CNBC Fed Survey, released as the central bank begins a two-day meeting, shows 84 percent of respondents think 2015 will mark the Fed's first rate hike in nine years. But the 38 respondents don't see the Fed tightening policy until October, two months later than in the previous survey. The median month forecast as the first for a rate hike, a more stable measure, is September for both the current and previous surveys. (Tweet This)

Meanwhile, the funds rate is seen ending the year at just 0.54 percent, down from 0.63 percent in the March survey.

"While the Fed seemingly wants to move off of a near-zero monetary policy, they have painted themselves into a bit of a corner if they remain 'data dependent,' " Kevin Giddis of Raymond James/Morgan Keegan wrote in response to the survey. "The current data is working against them."

Read MoreWall Street cuts growth outlook for Q1 and beyond

Survey respondents see a bigger effect from the stronger dollar than they did previously, with the greenback seen shaving a third of a point off U.S. growth this year, up from a 0.22 percent estimate in March. And respondents continue to forecast inflation at just 1 percent this year, a full point below the Fed's 2 percent target.

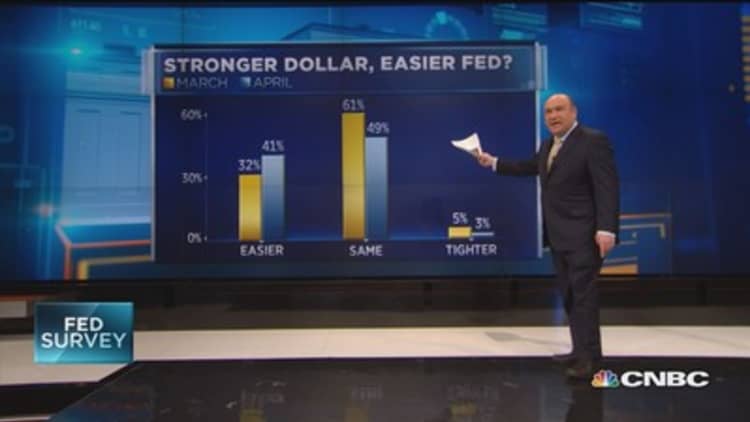

All of this plays into the outlook for Fed policy, with 41 percent of respondents now seeing an easier Fed policy than previously forecast because of the strong dollar, up from 32 percent in the prior survey. "Earlier this year I thought the first Fed rate hike would come by June," wrote Rob Morgan of Sethi Financial Group. "Now I think low oil prices and the strong dollar will keep inflation low enough to push the hike off to September."

The Fed and markets can't quite seem to get on the same page when it comes to the outlook for interest rates over the long term.

Not just when, but by how much

The April CNBC Fed Survey also shows investors lowering their forecasts for how much the Fed will hike. The 38 respondents see the funds rate at 1.46 percent at the end of 2016, a full 40 basis points below the median estimate of the 17 members of the Federal Open Market Committee. Over the long run, FOMC members see the Fed Funds rate at 3.75 percent, while the survey shows the Fed stopping the current hiking cycle at 2.85 percent.

That gap had narrowed after the March meeting when the Fed brought its own forecasts closer to the market's expectations. But now the market has reduced them again, maintaining a smaller but still sizable gap with the Fed.

Read MoreBig money: 'Awfully dangerous' to take risk now

The danger for the Fed is that markets won't be prepared for the amount of tightening that would occur if the Fed follows the path of its own average forecasts. It also raises questions about Fed communication, whether central bank officials are adequately explaining to markets their views on the future path of interest rates.

"I think the market is underestimating the path of rate hikes over the next two years as unemployment is seen falling below 5 percent by year end and as inflation starts to move back up," said John Ryding of RDQ Economics.

To be sure, the most severe differences are in outlying years, giving the Fed time to prepare markets or to change its own views.

"The Fed is going to spell out three or four months in advance of the first hike almost exactly what they will do and when they will do it," wrote Scott Wren of Wells Fargo Advisors. "They will use Fedspeak but there will be no question as to when the initial hike will occur and what the pace will be."

In other survey findings:

- Chair Janet Yellen's ratings have gone up since last year, with her average grade at B+ and 36 percent of respondents giving her an A. That's better than the B- that Ben Bernanke got in his last grade as chairman. Yellen has better marks than her predecessor did in nearly every category, including communication, economic forecasting and transparency.

- Despite recent stability in the dollar/euro exchange rate, respondents to the CNBC still see the euro falling to parity against the greenback. As companies continue to cite currency concerns in their earnings, 78 percent say the strength in the dollar is bad for U.S. economic growth and corporate earnings.

- Two-thirds of respondents say the recent weakness in the economy is temporary and that the economy will bounce back in the second or third quarter. Estimated average growth of 2.7 percent this year and 2.8 percent next year are little changed from the prior survey despite recent headwinds. Forecasts for the S&P 500 are higher in 2015 and 2016.

- Half of respondents say the stock market has not discounted a rate hike by the Fed this year.

- The estimated 2.89 percent yield on the 10-year Treasury in December 2016 marks the first time it's been forecast to be below 3 percent.

- The market thinks the job market has more room to run even than the Fed does, with the average measure of full employment in the U.S. at 4.8 percent, below the Fed's 5.1 percent.

- There's a 39 percent probability that Greece will leave the euro zone in the next there years, and an 11 percent chance that Portugal will leave.

- Global economic weakness remains the single biggest threat facing the U.S. economic recovery, followed by tax and regulatory policies.

- The chance of a recession remains historically low at just 14.7 percent, down from 16.4 percent in the prior survey.

- The low point for oil prices in the current cycle is forecast to be $42.15, up from $39.95 in the last survey.