On a day when investors are worried about issues in Greece and a strengthening dollar, Jim Cramer thought it was worth taking a closer look at what the future could hold for the euro.

To get an expert opinion on the topic the "Mad Money" host turned to Carley Garner—technician, co-founder of DeCarley Trading, and author of "A Trader's First Book on Commodities" and colleague of Cramer's at RealMoney.com.

"When the euro is weak versus that dollar, that makes it much harder for U.S.-based international companies to compete with European ones, especially in Europe itself. With a weak euro, all of the profits that our multinationals make in the euro zone translate back into fewer dollars," Cramer explained.

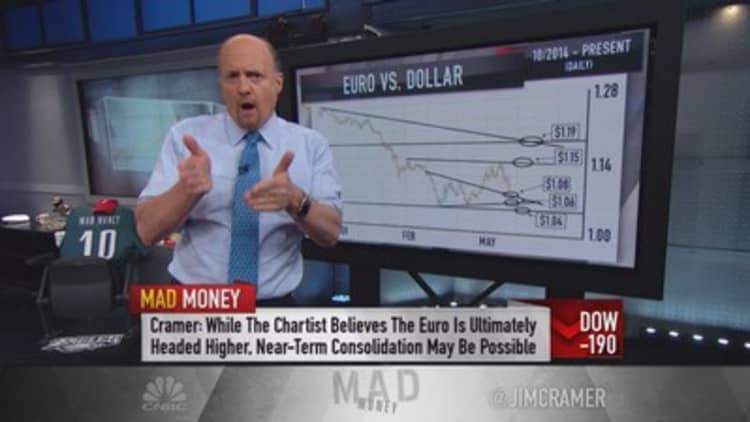

In fact, it wasn't that long ago that experts thought that the euro and dollar would reach a 1-to-1 exchange rate. And it really seemed like that would happen a few months ago, until the rate hit $1.04 and never went below that level. But just because the currencies didn't reach parity back in March doesn't mean it couldn't happen.

Garner pointed out that ever since the euro bottomed back in March, bearish sentiment has been growing and many think that the currency is set to plummet any minute now.

Everyone except for Garner, that is.

"She believes the euro is going higher, and anyone who thinks it's richly valued is just kidding themselves," Cramer added. (Tweet This)

Why?

Looking at the monthly chart of the euro, Garner saw that in the long term this recent rebound of the currency is nothing compared to what has happened in the past. Meaning it's not even close to being as high as it could be which Garner interprets as meaning it has a lot more room to run.

For example, in mid-2010 the euro bottomed near $1.18 and ran up to just under $1.50. Huge! Past rallies have covered approximately 30 cents, yet the current rally has only covered 10 cents at best.

"If the pattern of these past recoveries repeats itself, then Garner believes the euro could trade to $1.34, which would represent a gigantic rally that takes us right back to the top of the trading range," Cramer said.

One important point that Garner made is that the euro appears to have two long-term floors of support at $1.06 and $1.04. She believes that if the currency goes below $1.04, then investors should worry. But if that does not occur, then it will go to the top of the trading range.

However Garner also sees a powerful floor of support around $1.08 where she thinks the currency will trade sideways for a while before the rally takes off. A key figure to watch is $1.15, which she believes will spark the momentum needed to go to the $1.30s.

----------------------------------------------------------

Read more from Mad Money with Jim Cramer

Cramer Remix: Shutting down the haters

Cramer invests in America—Battlefield to boardroom

Hampton Creek: The bird flu weapon

----------------------------------------------------------

Another key piece of evidence is the Commodity Futures Trading Commission's Commitments of Traders Report. This is the report that tells investors what the big institutional players are up to in the futures market. According to the CFTC, there is a humongous short position in the euro for hedge funds and mutual funds. In Garner's view, that means they will be covering their short positions in the near future.

"Nobody has ever bet against the euro this aggressively before, but this is despite the fact that the European economy is finally recovering," Cramer added.

This is exactly why Garner expects a snapback rally of the euro, and Cramer also believes that it is just getting started. Ultimately a strong euro is good news for many American companies, which could be good news for your pocket, too.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com