Battle lines have been drawn among Wall Street's top economists over when the Federal Reserve will hike rates for the first time in nine years.

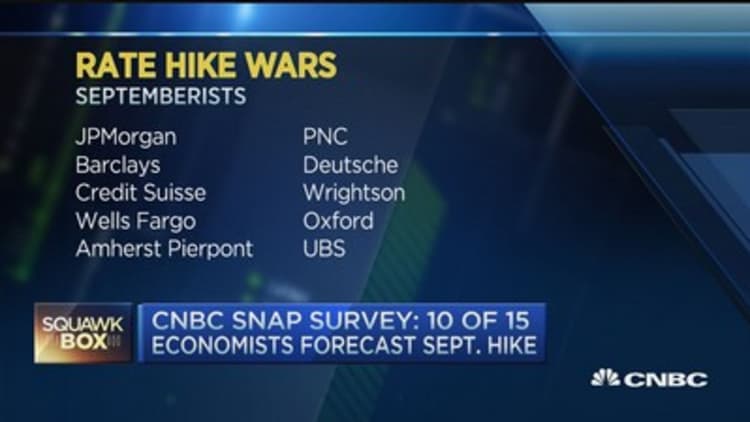

A snap survey conducted Thursday by CNBC found 11 of 17 economists still forecasting the first rate hike to come in September, despite the market's dovish read of the FOMC's July minutes.

"We retain our call for September liftoff," Barclays' Rob Martin said in a note. "However, we see the bar for the rate hike as having been pushed a bit higher."

Read MoreCME traders cut September Fed rate hike chance to 24 percent

The minutes from the Fed's July meeting indicated the conditions necessary for an increase in the federal funds rate "were approaching" but had not yet been achieved. Fed officials were upbeat in their assessment of the labor market, a view that has been supported by recent jobs data, but were less sure of the outlook for inflation.

"We maintain our view that the FOMC will engineer rate liftoff in September based on our near-term forecasts for a rebound in headline inflation and continued solid employment and overall economic data," Oxford Economics said in a note. "However, the lack of a clear signal from the FOMC, just four weeks before the Sept. 16-17 policy meeting suggests the odds for liftoff at that meeting have declined."

Economists from JPMorgan, Credit Suisse, Wells Fargo, Deutsche Bank, PNC, Oxford Economics and UBS also reaffirmed their calls for a rate hike at the September meeting.

"We continue to expect the first rate hike in September but maintain that this is a very close call," JPMorgan economist Daniel Silver said in a research note Wednesday night. "The news since the meeting has likely reinforced the committee's views on labor markets and its concerns about inflation."

CNBC's snap survey found five economists reiterating their forecasts for a December rate hike, among them Goldman Sachs and Morgan Stanley.

"There was no clear signal in the minutes that the Fed favored a hike at the September meeting, with 'almost all' members needing to see more evidence before they would feel 'reasonably confident' in the inflation outlook," Goldman said in a note.

Economists in the December hike camp cite risks to the Fed's inflation target, including the decline in energy and commodity prices since the committee last met. Fed staff lowered their inflation outlook at the July meeting but said most of the effects from lower energy and import prices were transitory. Fears over weakness in China's economy have also flared since the last meeting.

"Since the meeting the U.S. dollar and energy have moved in the wrong direction," Morgan Stanley said. "The Fed wants to raise rates this year, but we continue to believe it takes a pass in September."

On the far side of the debate over the Fed's timeline, Stifel Chief Economist Lindsey Piegza said the inflation data was reversing course toward the Fed's longer-term target, repeating her call for liftoff in 2016.

"The economy remains substandard and inadequate, unable to justify a near-term rate increase," she said. "No matter how impatient the market or Fed officials are to get 'things going,' it is all about the data, and the data says the economy needs more time to improve further."

Read MoreSt. Louis Fed official: No evidence QE boosted economy