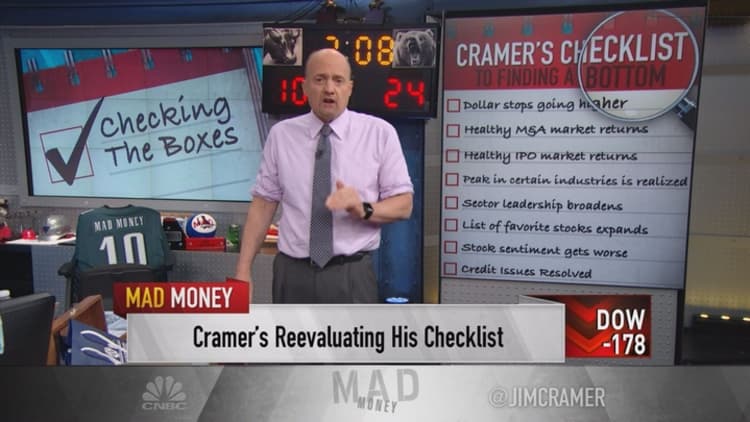

Jim Cramer couldn't find many positive signs in the market on Monday, which is why stocks ended in the red at market close. And when he went back to look at his market-bottom checklist, he realized stocks were nowhere close to bottoming.

"The list reminds us, first, why we are selling off, and second, what could put an end to the pain," the "Mad Money" host said.

When Cramer checked up on the status of his market-bottom checklist, he even ended up adding to it instead of reducing it.

No. 1 was clarity from the Fed. The Fed is in a bind because as the economy has slowed but employment hasn't. The Fed is worried that the economy will overheat, but there is no overheating. Cramer needs to hear from Janet Yellen that her plan for multiple rate hikes is off the table, or there will be more pain ahead.

No. 2 There needs to be resolution for political uncertainty. Cramer has no idea who the presidential candidates will be, and it seems that they have all hardened their stances against business.

If we rally, you need to sell something, raise cash, and get ready for lower prices.Jim Cramer

No. 3 China needs to get better. At least its stock market is closed for the Lunar New Year. No check, just a respite.

No. 4 Commodities must bottom. "All I can say is that commodities are trying hard to put in a bottom, but it's too early to declare one," Cramer said.

No. 5 Oil needs to stabilize. Oil has been acting better, but it needs to stabilize.

No. 6 There must be improvement on geopolitical issues. North Korea was at it again this weekend with a rocket launch, so this box cannot be checked off, yet.

Read more from Mad Money with Jim Cramer

Verizon CEO confirms interest in buying Yahoo

Cramer game plan: Beware this falling knife

Ford CEO: Auto industry is being underestimated

No. 7 Zombie companies must be put to death. On Monday, Chesapeake Energy plunged 33 percent on fears that it could struggle to pay the $500 million in debt that it has when it matures next month. Cramer wants to watch this situation closely because it could cause major weakness for stocks.

No. 8 Relief from the strong dollar. Cramer was surprised to learn that because of a huge decline in the dollar versus the euro, the exchange rate is almost back to where it was last year. He's not ready to call an all-clear on this one, but it is getting close.

No. 9 More mergers and acquisitions. Nope. Not even close. There have been almost none.

No. 10 A return of a healthy IPO market. Again, not even close. "In fact, this is one of the worst times I've ever seen for new offerings," Cramer said. (Tweet This)

No. 11 Peaks in the economy. Cramer has been watching the stocks of cellphone makers, automakers and homebuilders for signs of a bottom to signal that peaks may not be for real. But the stocks just keep falling.

No. 12 Sentiment must become more negative. Stocks are down bad, but the Dow Jones industrial average still hasn't taken out January lows and isn't oversold yet.

No. 13 Sector leadership expansion beyond FANG. While Facebook, Amazon, Netflix and Google-parent Alphabet have definitely been lost, there is no leadership besides gold, which was not what Cramer wanted to see.

No. 14 Domestic companies must do better from low oil prices. Besides Clorox, no companies have experienced a break to their bottom line from cheaper gasoline.

Cramer was disturbed by the lack of progress when he reviewed this checklist. In fact, he even decided to add a new item to the list:

No. 15 Credit issues must be resolved. There are oil companies all over the place saying credit has become more difficult to get. At the same time, there is fear about European banks and credit issues they may have. This potential credit crunch could turn into a real issue if not resolved.

Until there are more boxes checked off, Cramer recommended only nibbling at the stocks of high-quality companies.

"If we rally, you need to sell something, raise cash, and get ready for lower prices," Cramer said. (Tweet This)

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com