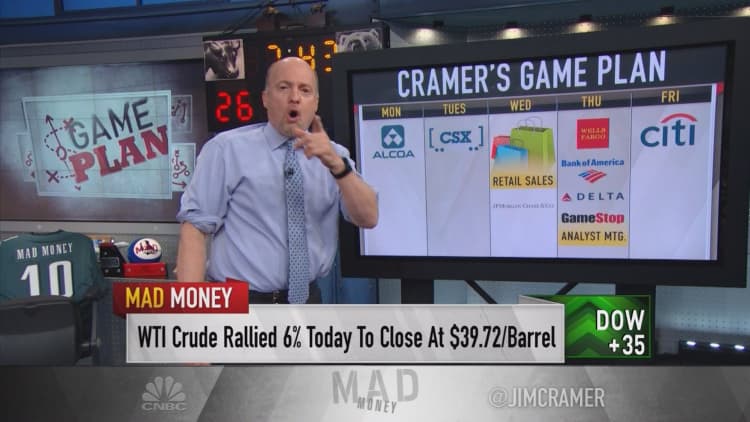

Next week is one of Jim Cramer's favorite weeks of the year for earnings. Investors can finally get past chatter of the Federal Reserve and politics and focus on the fundamentals of earnings.

Unfortunately, Cramer isn't a big fan of many of the stocks that report.

"My advice? Listen, learn, find out. Sometimes there is not that much money to be made. Next week is one of those times," the "Mad Money" host said.

Here's what's on his radar for next week:

Monday: Alcoa

Alcoa is splitting into two separate companies, soon. The first is an engineered proprietary business and the second is a low-cost maker of commodity aluminum. Cramer has only liked the proprietary part of Alcoa, but if the Commerce Department adds aluminum tariffs, like it did with Chinese steel, then he thinks Alcoa's aluminum business could do well, too.

"I say listen to the call, I don't expect a blowout quarter, and then get ready to buy the company that is about to break itself up," Cramer said.

We aren't big fans of any of the stocks that report next week, although the decline in Delta ahead of the quarter does intrigue me.Jim Cramer

Tuesday: CSX

Amid rumors that Canadian Pacific wants to buy CSX, Cramer says to never speculate on takeovers where the fundamentals are weak. Much of CSX's business is related to coal, and Cramer thinks it could be weak.

Still, Cramer is interested to hear whether CSX discusses how it will be involved when the Panama Canal is widened. He believes large exporters would rather deal with East Coast ports serviced by CSX. So, he is willing to put it on the buy list after it reports.

Read more from Mad Money with Jim Cramer

Cramer Remix: Washington's war on you

Cramer: Sanders' attack on business is unprecedented

Cramer: Stocks on fire you've never heard of

Wednesday: Retail sales, JPMorgan

Cramer considers the retail sales number to be the most important macro data point of the week. Last time these numbers came out they were terrible, and then the government revised the previous month's down, too. Consumers just aren't spending enough to generate good GDP growth, and Cramer is hoping something good will come from these numbers.

"I think it was a major domestic reason why the Fed held off raising rates," Cramer said.

Thursday: Bank of America, Delta, GameStop analyst meeting

Delta: Cramer thinks the airline stocks are dirt cheap. Investors will find out just how cheap they are when Delta reports. Usually if a stock sells at just six times next year's earnings, it means that the company cannot make the earnings.

"In this case, I think Delta is doing so well and the stock is so low that opportunity may be knocking, especially if you believe, as I do, that oil is staying lower longer. If there were a stock to buy before it reports next week, I think it would be Delta," Cramer said.

Friday: Citigroup

Cramer's not expecting any surprises. Sometimes there is a call for Citigroup to break up to unlock value, but he doubts it will happen this time. He expects the same tone heard from other banks, so if those banks go down, Citi could go down, too.

"We aren't big fans of any of the stocks that report next week, although the decline in Delta ahead of the quarter does intrigue me, as does the stock of Alcoa, after the quarter is announced but before they execute the break-up," Cramer said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com