Uncertainty around whether Broadcom could buy Qualcomm — an event that would have been the largest technology takeover ever — wasn't the only thing weighing on negotiations, Qualcomm's CEO told CNBC on Wednesday.

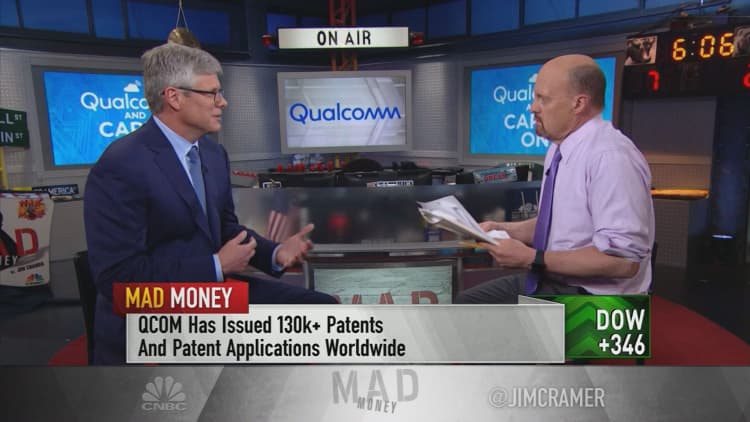

"I think it was a situation where there were some questions about deal certainty, which clearly became the case, but I think it's also a case where it's very difficult to buy a company using a hostile [bid]," Qualcomm CEO Steven Mollenkopf told "Mad Money" host Jim Cramer.

The deal, which valued shares of Qualcomm around $80, was blocked by President Donald Trump, who cited national security concerns, according to a White House statement.

But Broadcom's fighting tactics also gave Qualcomm's top brass pause, Mollenkopf said.

"You really have to engage with a company through the front door," he told Cramer when asked whether the deal would have gone through at the $82-a-share valuation Broadcom offered.

Broadcom declined to comment on Mollenkopf's remarks.

"If somebody had something like that, we would of course look for ways of driving value," Mollenkopf continued. "But we have a pretty good plan and we're going to drive it."

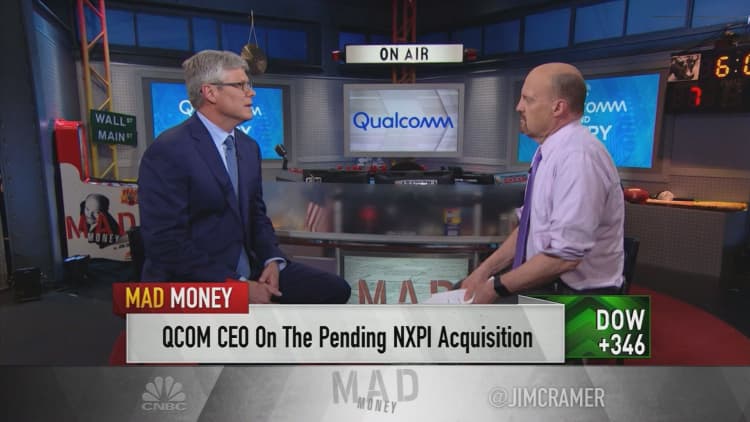

In an ideal world, that plan will include NXP Semiconductor, a Dutch chipmaker for which Qualcomm has made a merger bid, the CEO said.

Qualcomm, which makes semiconductors and other wireless technologies, is currently awaiting approval from Chinese regulators, the last of nine sign-offs needed to begin the merger process. Tense trade talks could throw a wrench in the negotiations, but Mollenkopf reiterated his optimism about the deal going through.

"When we extended the deal with NXP, we did it on purpose to get on the other side of some political milestones, one of them being the discussion on tariffs, because we thought that would provide an opportunity for a deal to get done," the CEO explained Wednesday.

"I don't think we've seen anything that was inconsistent with the strategy that we put in place to extend that agreement," he continued. "So I'm hopeful, I'm optimistic and I'll tell you, we are very prepared to execute on it."

A dispute with Apple about Qualcomm's pricing has also weighed on shares of the chipmaker, but Mollenkopf stood his ground there, too.

"Look, we have a contract. It's a very clear contract. It's consistent with what everybody else in the industry pays including Samsung," he told Cramer. "Our experience with this is that these things get resolved. It takes a while sometimes, but we're on the back end of that process [with Apple]."

Lastly, Mollenkopf didn't seem phased by Wednesday's news that former Qualcomm CEO Paul Jacobs and two other ex-Qualcomm executives would start their own wireless technology company.

"First of all, we wish Paul luck and there's a lot of our friends working on that," the CEO said. "And if there's something that transpires, of course we'll listen to it. But we're really focused, as you know, on driving some near-term milestones which we think are going to create some value."

Watch Steven Mollenkopf's full interview here:

Disclosure: Cramer's charitable trust owns shares of Apple.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com