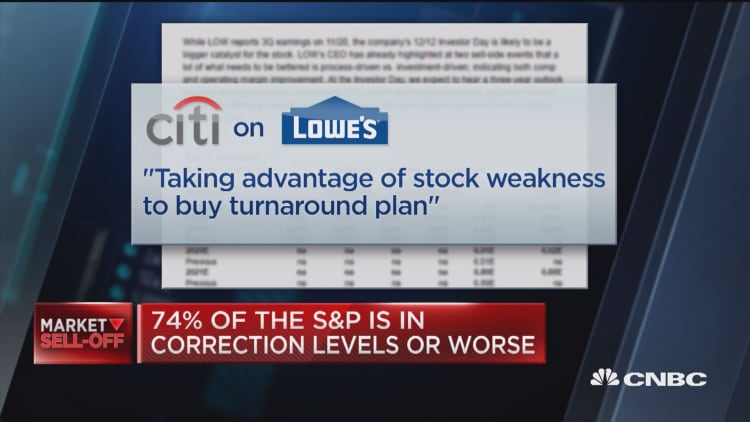

Shares of Lowe's are down nearly 15% month-to-date as fears of rising rates weigh on the homebuilding space, but Citi says the dip creates an attractive entry point to buy the stock.

On Tuesday Citi analyst Kate McShane upgraded the North Carolina-based company to buy from neutral . "We have been believers in LOW's turnaround plan given the strength of management and the many process changes taking place to make the company more competitive. Recent stock weakness allows us to become more constructive on the name," she wrote in a note to clients. McShane has a $112 price target on the stock, which is a 14% upside from Tuesday's close.

Farr, Miller & Washington President Michael Farr owns the stock, and is sticking with it despite the sharp pullback. He likes the fundamental story, and also believes it is insulated - to a certain degree - from the Amazon and e-commerce threat.

"I like the price; I like the dividend; I like the growth rate. They're in a tough space in retail but you can't Amazon sheets of plywood," he said on Tuesday's "Halftime Report."

The homebuilding sector more generally has been under pressure on fears of higher interest rates slowing demand. The ITB, which tracks companies in the home construction sector, is on pace for its worst month since June 2010. But Farr believes rising rates could actually help Lowe's since the company focuses on home improvement.

"When you see interest rates start to go up, if there's a little pressure on home sales the DIY trend comes back. I think at these prices you've got something you should buy," he said. HPM Partners' Jim Lebenthal echoed this point, noting that Lowe's has been unfairly dragged down by broader sector weakness. "I think this thing [Lowe's] is beaten down enough. I think the fears about housing falling off a cliff are over placed...if they [Lowe's] control margins it should be off to the races," he said on the "Halftime Report."

One of McShane's primarily reasons for bumping her rating on Lowe's to a buy is the management team, which she believes has created a turnaround plan that will unlock future value.

"New CEO Marvin Ellison has revamped LOW's management team and refocused the organization on improving the supply chain, inventories, omni-channel initiatives, and in-store products and services," she wrote in her note upgrading the stock.

Like McShane, Pete Najarian, who owns the stock, believes the company's new management team will drive gains going forward. "Here's what I like the most: the management...The leadership really does matter...online and in stores this guy [Marvin Ellison] is the man," he argued.

But not everyone believes the company has a bright future ahead. Stephanie Link, managing director at Nuveen which has $970 billion in assets under management, believes that at 17X forward earnings investors are paying too much for lackluster growth.

"They [Lowe's] have under-invested all these years so I actually think the earnings power isn't what people think it is," she said on Tuesday's "Halftime Report."

Shares of Lowe's are up 5.57% for the year, and the company yields 1.96%.