Shares of U.S. airlines tumbled Thursday after Delta Air Lines forecast slightly lower revenue growth, following downbeat sales projections from iPhone-maker Apple that stoked concerns of a global slowdown.

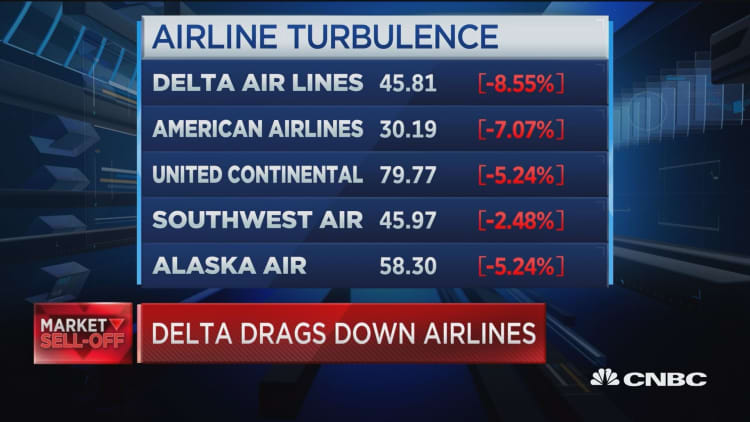

Delta shares fell nearly 9 percent, their steepest percentage decline in more than six years, to close at $45.61. American Airlines shed more than 7 percent, recovering slightly after hitting its lowest price since July 2016. United Airlines lost 5 percent, while Southwest Airlines ended the session more than 3 percent lower.

Delta warned investors before the market opened that its unit revenues in the last three months of the year, a gauge of airfare, likely rose 3 percent, down from a previous forecast of 3.5 percent. The Atlanta-based carrier said yield growth from last-minute bookings "was more modest than anticipated" in December.

The selloff presents airline executives with a tough crowd to please when they start reporting earnings this month. Delta is expected to report in the middle of the month. Investors have been skeptical of the sector, even though it's heading for its ninth year in a row of profitability. Spirit and United were the only two U.S. airlines whose shares gained in 2018.

Unlike travelers, investors like to see that airlines can raise fares to increase revenue. Adding to concerns is the recent slide in oil prices. Cheaper fuel is positive for airlines' bottom lines since it's generally their biggest single cost after labor.

But some worry that airlines will just offer cheaper fares to compete, said Helane Becker, airline analyst at Cowen & Co.

"This is exactly why investors are apprehensive about getting involved in the group in a declining fuel environment. In the past, the airlines have competed away gains from lower fuel as they reward customers with lower fares," she wrote. "With oil trending lower in recent months, investors are worried this time will not be different."

Airline shares fell more than the broader market, which slid after Apple warned that its fiscal first-quarter sales would be lower than expected, blaming a slowing Chinese economy. The NYSE Arca Airline index, which tracks 15 carriers, fell nearly 4 percent, while the S&P 500 dropped more than 2 percent.

Delta said both leisure and business-travel demand was "healthy" in the fourth quarter. But airlines can be particularly sensitive to worries about slowing economies because lucrative business travel spending ebbs and flows with economic growth.

Still, it issued a fourth-quarter profit forecast of $1.25 to $1.30 per share — at the high end of a previous outlook it provided in the fall.

Smaller airlines' shares also fell. JetBlue Airways lost more than 1 percent, discount carrier Spirit Airlines lost 6.7 percent and Alaska Air dropped 5.5 percent.