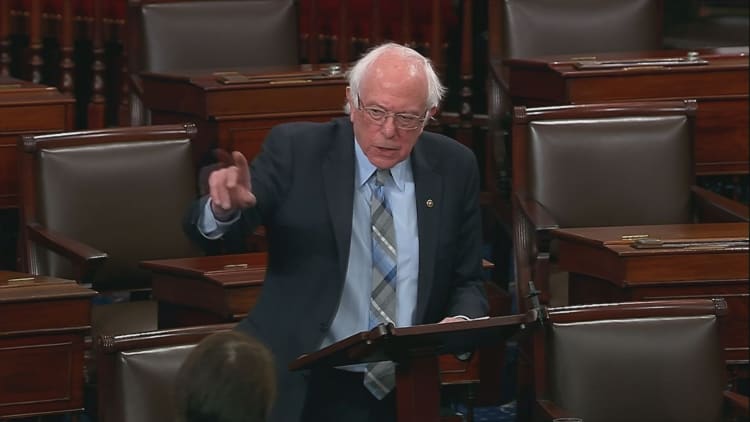

Sen. Bernie Sanders plans to introduce an expanded estate tax plan with rates up to 77 percent as he explores another run for the presidency.

Sanders touted the plan on Twitter after The Washington Post first reported it Thursday morning.

The "For the 99.8% Act" would tax the estates of those who inherit more than $3.5 million, which Sanders estimates is 0.2 percent of the country. Currently, the estate tax only applies to individuals who inherit more than $11 million, as a result of the 2017 Tax Cuts and Jobs Act passed by Republicans.

The debate over tax policy is heating up, as Democrats looking to unseat President Donald Trump in 2020 try to use the GOP tax law against him. The measure, which slashed taxes for corporations and included individual tax cuts that favored the wealthy, largely did not resonate with voters in midterm congressional elections last year.

Recent polling shows that most Americans favor raising taxes on the rich.

Sanders' proposed estate tax rates are:

- $3.5 million to $10 million: 45 percent tax

- $10 million to $50 million: 50 percent tax

- $50 million to $1 billion: 55 percent tax

- more than $1 billion: 77 percent tax

The Post, citing Sanders aides, said the plan would raise $2.2 trillion from 588 billionaires, although it is unclear how long it would take to raise the money. Over the next 10 years, however, Sanders staffers told the Post the levy would reap $315 billion.

Sanders' plan would restore the estate tax rate to levels not seen since the 1970s. Earlier this week, Republican Sens. Mitch McConnell, Chuck Grassley and John Thune introduced a plan to repeal the estate tax, calling it an "unfair death tax."

Sanders slammed his GOP colleagues' proposal.

"Incredibly, Republican leaders in the Senate have introduced a bill to repeal the estate tax for the richest 1,700 families in America. That's absurd," he tweeted. "From a moral, economic and political perspective our nation will not thrive when so few have so much and so many have so little."

A spokesman for Sanders' Senate office did not immediately respond to CNBC's request for comment.

The senator's bill follows several other tax plans introduced by prominent Democrats in recent weeks.

Sen. Elizabeth Warren of Massachusetts, who has launched a presidential exploratory committee, proposed a 2 percent "wealth tax" on Americans with a net worth greater than $50 million. Freshman Rep. Alexandria Ocasio-Cortez of New York has floated a 70 percent marginal tax rate on income over $10 million. Both plans have received pushback from Republican lawmakers and Wall Street executives, as well as from former Starbucks CEO Howard Schultz, a one-time Democrat who is seriously exploring an independent run for the White House.

Sanders, an independent who caucuses with Democrats in the Senate, is considering a run for president in 2020, after coming in as the runner-up behind Hillary Clinton in the 2016 Democratic primary. Earlier this month, he introduced bills to raise the federal minimum wage from $7.25 to $15 an hour and lower the costs of prescription drugs.