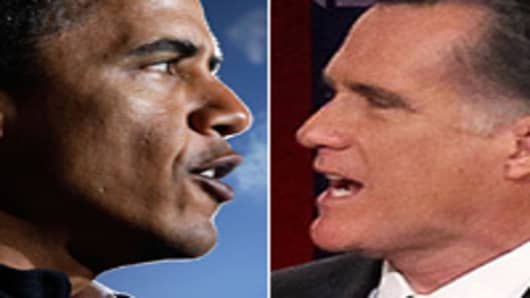

Most everyone has an opinion on who will win the presidential election next Tuesday, but in all the prognostication one question has gone mostly overlooked: What if no one wins?

Sure, someone ultimately will be the declared the victor.

But the idea that the Nov. 6 balloting could come and go without a winner decided for days, weeks or even months is an increasingly likely possibility only a few have explored.

"I do think there's a chance we will not know on Wednesday morning the 7th who won," said Greg Valliere, chief political strategist at Potomac Research Group in Washington, D.C. "To have an election potentially not be definitive and dragged out for maybe several days or longer — that's not a good story."

Superstorm Sandy has only heightened that unease, throwing into question whether many thousands in storm-damages states will even have the logistical needs of power and transportation to conduct a valid election. (Read More: Presidential Campaigns Go Full Tilt After Storm Break)

Valliere said Sandy has had a "significant impact" on the race, primarily benefiting Obama who has displayed "leadership skills" and helping negate momentum that Romney had been enjoying since he trounced the president in the first debate last month.

But that also enhances the probability that the winner could be in flux even after Tuesday's voting.

"I continue to believe there's a chance we may not know the winner next Wednesday morning," Valliere said. "Several key states mandate a recount if the final margin is less than 0.5 percent, and there may be a lengthy examination of provisional ballots in Ohio."

As things stand, the campaign is virtually deadlocked.

A consensus of polling from the Real Clear Politics web site shows each candidate garnering exactly 47.4 percent of the vote but President Barack Obama holding an Electoral College lead of 290-248. That assumes his small advantages in several swing states hold up.

Online gambling site Intrade still rates Obama a clear favorite.

Republican challenger Mitt Romney holds a narrow lead in the Rasmussen poll, which a Fordham University study found to be the most accurate measure in the 2008 race.

How markets will react to the chaos and confusion that would surround an election that didn't produce a clear winner is uncertain.

As Valliere pointed out, the oldest cliche on Wall Street is that the market hates uncertainty. The consequences of this particular level of uncertainty could be massive.

Consequently, investors who have enough to worry about may get another problem to mull.

Much has been discussed about the "fiscal cliff," a reference to a series of spending cuts and tax increases that will take effect automatically if Congress fails to reach deficit-reduction targets by the end of the year.

While a slew of worst-case scenarios have been bandied about, Wall Street has remained fairly unbothered, sending stocks on a continuous path higher until a weak earnings season got in the rally's way.

But a power vacuum in Washington could change all that, with neither party having a mandate nor a clear path toward resolving the outstanding fiscal issues. (Read More: Companies Are Sitting on More Cash Than Ever Before)

"Wall Street is way too sanguine about the fiscal cliff," Valliere said. "It will be resolved eventually and I don't think it will be horribly negative. The problem is the timing. I could see the fiscal cliff getting dragged out through the first quarter (of 2013), maybe through the end of the second quarter.

"If you believe the reason the economy is mediocre is because nobody wants to make long-term plans, this gridlock, if it persists into next year, would reinforce concerns about very mediocre GDP growth." (Read More:Economy Grows at 2% Rate; Government Provides Lift)

Valliere thinks there's a 1 in 5 chance that Obama loses the popular vote to Romney but wins the Electoral College, a scenario that would award the Democratic incumbent a second term but likely would create unrest.

That outcome raises the dark specter of the 2000 race between Republican George W. Bush and Democrat Al Gore, in which Bush ultimately won in the Electoral College despite Gore getting more popular votes. The protracted post-election battle inflicted substantial damage on financial markets.

The chance for such a scenario is remote but potentially dangerous, said Tina Fordham, senior global political analyst at Citigroup.

"The winning candidate has won the Electoral College but lost the popular vote only once in the past 124 years," Fordham said in a recent note. "The possibility of outlier outcomes can't be eliminated, especially in today's fraught contest, but we underscore that the likelihood of a Bush-Gore split vote redux has about the same probability as NASA announcing the discovery of extraterrestrial life."

Fordham bases the latter analysis on numbers from Intrade, whose members indeed have assigned an electoral-popular vote split the same probability as life on Mars.

Still, with the race tightening and Romney gaining substantial ground in swing states, the possibility merits attention. (Read More: Romney Win Would Be Better for Avoiding 'Fiscal Cliff': Goldman)

"A close race or disputed result could reduce the political capital of the winner, diminishing prospects for a compromise solution for the 'fiscal cliff' in the 'lame duck' session of Congress and potentially pushing negotiations into the new legislative session in January 2013," Fordham said.

Revisiting the Bush-Gore race provides a snapshot of what could happen.

In the days after that election, Gore's decision to challenge the results preceded a 280-point intraday drop in the Dow industrials, and in the month after the Standard & Poor's 500 lost 8 percent.

In the run-up to the Supreme Court decision that ultimately awarded the Florida race, and the election, to Bush the stock market gained. But stocks then fell through December and into the following year, cratering after the Sept. 11, 2001 terror attacks and not recovering until 2007.

"The odds are rising that the victor will be elected by only a very thin majority," said Paul Ashworth, chief US economist at Capital Economics. "In a worst-case scenario, we could see a repeat of the Bush/Gore 2000 fiasco, with uncertainty over the result dragging on for several weeks."

In that case, the ultimate winner could find himself without a mandate or a means to address the pressing fiscal matters ahead.

"So even if we don't know the outcome of the presidential election race itself, it is looking increasingly like whoever wins could end up finding victory is a poisoned chalice," Ashworth said.