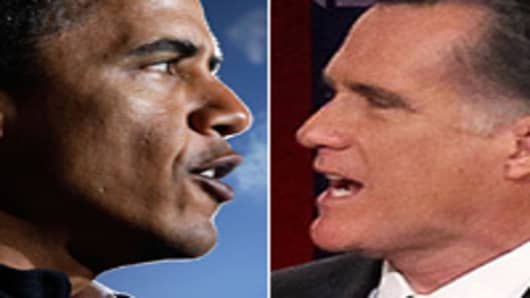

There may not be a more contentious issue between President Barack Obama and Mitt Romney in this election than taxes—and there may be no greater difference on where the candidates stand.

Here's what each of them have said publicly they would do about taxes.

Obama: In his first term, Obama and Congress created significant tax cuts for families and businesses, but some were temporary.

If re-elected, Obama has said, he would like to raise taxes on the wealthy and ensure they pay 30 percent of their income, which he says would help reduce the budget deficit. (Read More: What is the Deficit)

Obama said he supports extending Bush-era tax cuts for everyone making under $200,000, or $250,000 for couples. He had agreed in 2010 to a two-year extension of the lower rates for all taxpayers.

But that extention ends on Dec. 31, and Obama has said he would let the top two tax rates go back up 3 to 4 percentage points to 39.6 percent and 36 percent—and raise rates on capital gains and dividends for the wealthy.

A Treasury Department report says Obama's proposal to let the Bush tax cuts expire for top earners would hit only a tiny fraction of all small businesses—but it includes nearly 1 million companies.

Other taxes going up under Obama would be to help cover Medicare costs from the Affordable Health Care Law—with a tax on highest-value health insurance plans. (Read More: What is Medicare?)

Obama has said he would replace the Alternative Minimum Tax (AMT) with the "Buffett Rule," named after billionaire investor Warren Buffett. (Read More: What is the AMT?)

The AMT was originally designed to keep top wage earners from taking too many deductions, but it currently captures many middle-class families. The Buffett rule holds that millionaires shouldn't have a lower effective tax rate than anyone else—and that they should pay at least 30 percent of their income in federal taxes. (Read More: Warren Buffett Watch)

Obama would continue a 15 percent tax rate on dividends and capital gains for families making less than $250,000 a year.